The journey to financial freedom is a marathon, not a sprint. It’s a path that requires patience, discipline, and a solid understanding of financial principles. It’s easy to be enticed by the quick-money schemes, the “get-rich-quick” advice that floods online platforms, but those often lead to disappointment and regret. The real key to building wealth and becoming a millionaire lies in disciplined financial management, strategic investments, and a consistent mindset towards building long-term wealth.

Image: myans.bhantedhammika.net

If you’re diving into the world of personal finance, “Becoming a Millionaire” Chapter 3 Lesson 2 likely delves into the practical aspects of managing your finances. This chapter might cover budgeting, saving, debt management, and understanding investing basics. Building a strong financial foundation is crucial, as it provides the platform for you to confidently pursue your wealth-building goals.

Navigating the Path of Financial Management

Financial management is the bedrock of wealth creation. It’s about taking control of your money, understanding where it’s going, and making conscious decisions about how you spend, save, and invest it. This includes aspects like:

- Budgeting: Creating a detailed plan that outlines your income and expenses, helping you track your spending and identify areas for improvement.

- Saving: Setting aside a portion of your income regularly for future goals, like buying a home, retiring comfortably, or covering unexpected expenses.

- Debt Management: Managing existing debts strategically, prioritizing high-interest debts, and actively working towards becoming debt-free.

- Investing: Putting your money to work for you by exploring various investment options like stocks, bonds, real estate, or mutual funds.

Chapter 3 Lesson 2 of “Becoming a Millionaire” hopefully guides you through these essential financial management concepts and provides practical strategies for implementing them in your life.

Understanding the Value of Financial Literacy

Financial literacy is not just about crunching numbers; it’s about empowering yourself with the knowledge to make informed decisions about your money. It allows you to:

- Set Realistic Goals: By understanding your financial situation, you can set achievable goals that align with your aspirations.

- Make Informed Decisions: Financial literacy equips you to evaluate various investment options, choose the right financial products, and avoid costly financial mistakes.

- Build Confidence: Knowing you have control over your finances fosters financial confidence, helping you navigate life’s challenges and achieve your goals with greater assurance.

- Reduce Financial Stress: Proper financial planning and management minimizes financial stress, allowing you to enjoy life with greater peace of mind.

Financial literacy is a lifelong learning process. It’s not a one-time event but an ongoing commitment to staying informed about financial trends and strategies. It’s a journey that involves continuous learning, embracing new tools and technologies, and adapting your approach as your financial circumstances evolve.

Unlocking the Secrets: Key Takeaways from Chapter 3 Lesson 2

While we don’t have access to the exact content of the chapter, here are some general principles that Chapter 3 Lesson 2 of “Becoming a Millionaire” might focus on:

Image: jacobymeowirwin.blogspot.com

1. Living Below Your Means

This is a fundamental concept that underpins sound financial management. By spending less than you earn, you create a surplus that can be channeled towards saving and investing.

2. Prioritizing Financial Goals

Defining your financial goals is essential. Do you want to buy a house? Start a business? Retire early? Having clear goals helps you stay motivated and prioritize your financial decisions.

3. Automating Savings

Setting up automatic transfers to your savings account, even small amounts, can make a significant difference over time. This creates a habit of consistent saving without requiring active effort.

4. Recognizing the Power of Compounding

The magic of compounding is that your investments grow not only on the initial principal but also on the interest earned. The longer you invest, the more substantial the effect of compounding becomes.

Expert Tips for Financial Success

Here are some practical tips based on sound financial principles and expert advice, which can be valuable regardless of what Chapter 3 Lesson 2 covers:

- Track Your Spending: Use a budgeting app or spreadsheet to meticulously track where your money is going. This provides valuable insights into your spending habits and areas for improvement.

- Negotiate: Don’t be afraid to negotiate for better rates on loans, credit cards, or insurance policies. You can often save significant amounts over time by seeking better rates.

- Diversify Your Investments: Don’t put all your eggs in one basket. Diversify your investments across different asset classes (stocks, bonds, real estate) to mitigate risk and maximize returns.

- Seek Professional Advice: For complex financial situations or important decisions, consider consulting a financial advisor. They can provide personalized guidance and help you navigate the complexities of the financial markets.

Remember, building wealth is a long-term game. Consistency is key. Stick to your financial plan, invest regularly, and don’t be discouraged by short-term fluctuations in the market. Continuously learning and adapting to financial realities is crucial for long-term success.

FAQs about Financial Management

Q: How do I find the right financial advisor?

A: Look for an advisor with experience, certifications, and a good track record. Check their credentials, read client testimonials, and ensure their approach aligns with your financial goals and risk tolerance.

Q: What are some reliable online financial resources?

A: Websites like Investopedia, Khan Academy, and The Balance provide valuable financial information, articles, and educational resources to enhance your financial knowledge.

Q: What is the best way to reduce debt?

A: Focus on paying down high-interest debts first. Consider strategies like debt consolidation or snowball method to accelerate your debt reduction journey.

Q: How can I stay motivated on my financial journey?

A: Set achievable goals, track your progress, celebrate milestones, and find a financial accountability partner to help you stay motivated and accountable.

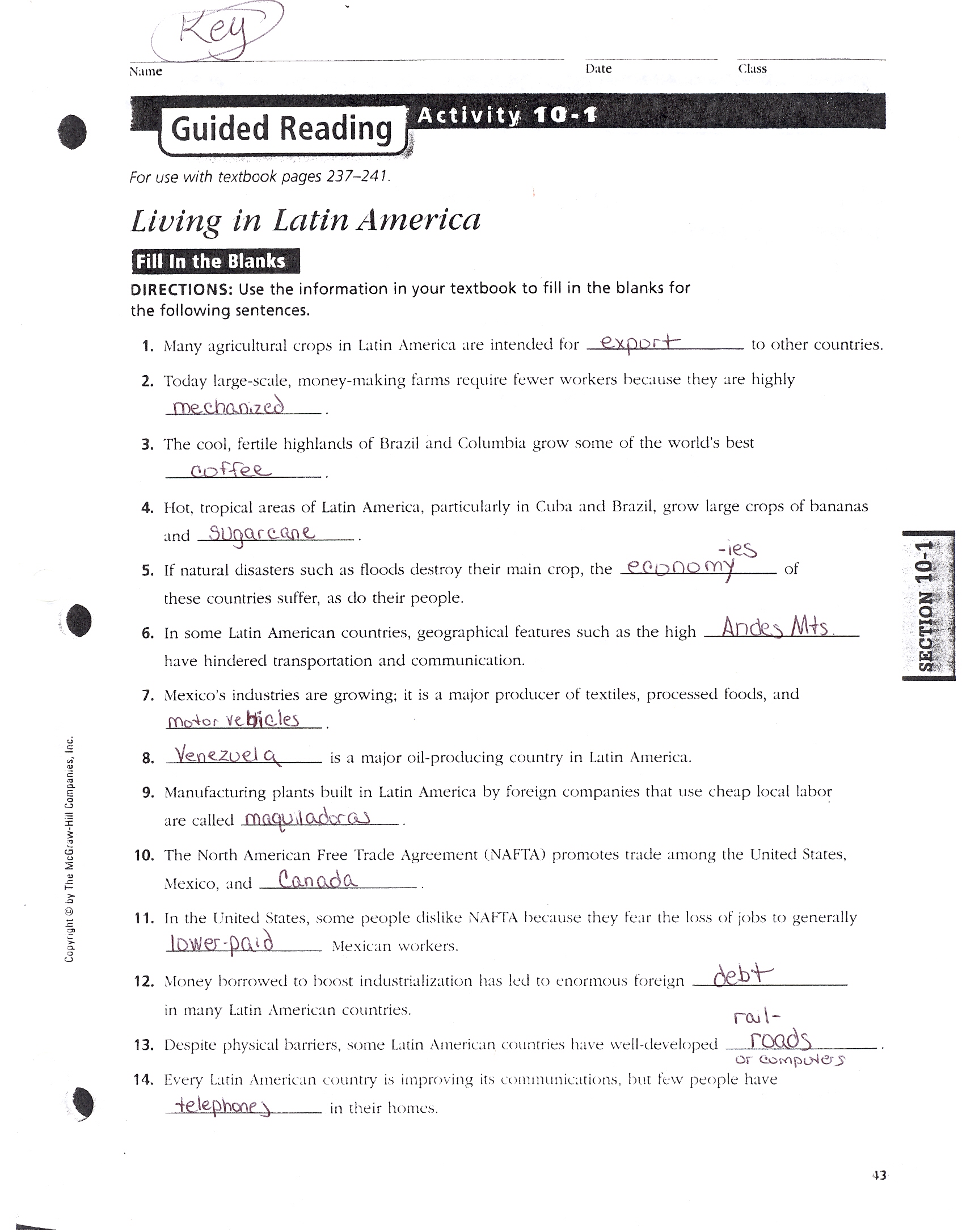

Becoming A Millionaire Chapter 3 Lesson 2 Answer Key

Embarking on Your Path to Financial Freedom

The path to becoming a millionaire is not paved with shortcuts. It’s about making responsible financial decisions, investing wisely, and embracing a long-term mindset. Chapter 3 Lesson 2 of “Becoming a Millionaire” is likely a stepping stone in this journey, providing valuable lessons that can equip you to manage your finances effectively.

Are you ready to embark on this journey? Let us know your thoughts and comments below, and feel free to share your own financial insights and experiences. Let’s learn from each other and build a brighter financial future together.