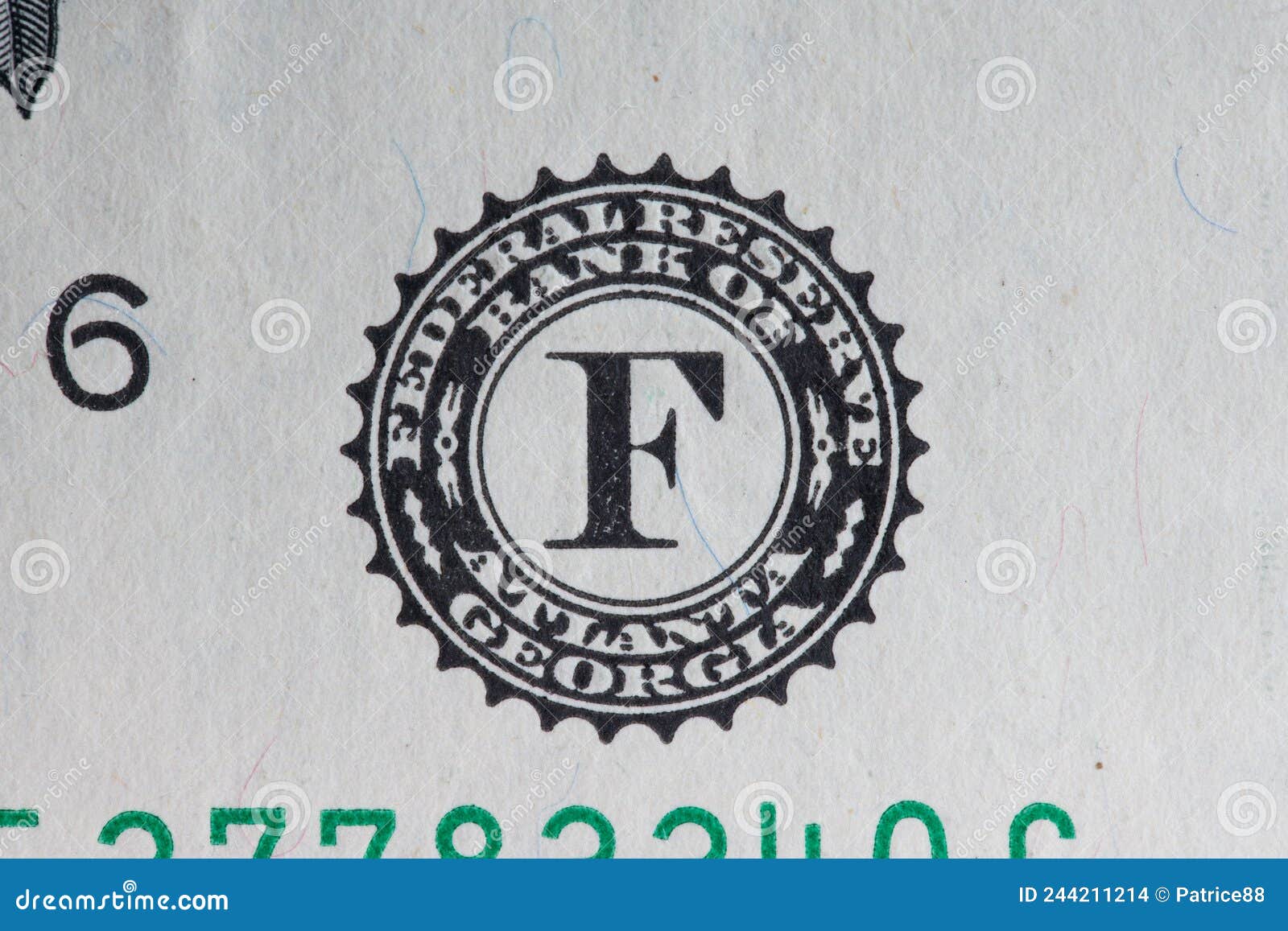

Have you ever wondered how your money moves between banks, seamlessly flowing from your checking account to pay bills or make online purchases? The answer lies within a complex network of financial institutions, regulated by a central authority, the Federal Reserve. This intricate web relies on unique identifiers, like a financial fingerprint, to ensure smooth transactions. One such identifier, often overlooked but incredibly significant, is the Federal Reserve Bank of Atlanta routing number – a crucial piece of the financial puzzle that plays a pivotal role in our daily lives.

Image: www.dreamstime.com

This article will delve into the fascinating world of routing numbers, particularly focusing on the Federal Reserve Bank of Atlanta. We’ll explore its origins, functions, and how it impacts our financial transactions. Get ready to unpack the secrets of this enigmatic number and gain a deeper understanding of the financial landscape it helps shape.

The Heart of the System: Deciphering Routing Numbers

Understanding routing numbers is akin to deciphering a secret code. They are nine-digit numbers assigned by the Federal Reserve to each financial institution, acting as a unique address for that institution within the nationwide payment system. Imagine it as a postal code for your bank, directing funds to the correct destination. The first three digits of a routing number identify the Federal Reserve district where the bank is located. The Federal Reserve Bank of Atlanta covers the southeastern region of the United States, including Alabama, Florida, Georgia, and other states.

When you send or receive money, your bank uses the routing number to identify which Federal Reserve bank to process the transaction. This intricate system ensures that your funds travel securely and efficiently across the nation. Think of it as a virtual highway for money, with each routing number serving as a distinct exit point, directing funds to their ultimate destination.

The Federal Reserve Bank of Atlanta: A Cornerstone of Regional Finance

The Federal Reserve Bank of Atlanta is one of 12 regional banks within the Federal Reserve System, each playing a crucial role in maintaining a stable and efficient financial system. The Atlanta Fed operates as a financial intermediary, facilitating transactions between banks and providing essential services to the financial industry in its region.

Its responsibilities range from supporting local banks through loans and other financial services to overseeing regional economic conditions and promoting financial stability. The Atlanta Fed’s core functions contribute to the smooth operation of the financial system, providing essential support to businesses and individuals in the region.

The Impact on Daily Life: Unlocking the Benefits

The Federal Reserve Bank of Atlanta routing number might seem like a mere technical detail, but its influence on our daily lives is substantial. Whenever you make a payment, transfer money, or deposit a check, this routing number plays a silent but critical role in ensuring these transactions are executed flawlessly.

Imagine a world without these numbers – payments might be delayed, transactions could be lost in the labyrinth of the financial system, and the economic engine might grind to a halt. Routing numbers bring order and efficiency to a complex network of interconnected financial institutions, guaranteeing the smooth flow of money and enabling us to conduct our financial lives effortlessly.

Image: wetheonepeople.com

Exploring the Intricacies: A Deeper Dive

To fully appreciate the significance of the Federal Reserve Bank of Atlanta routing number, we need to delve further into its specific functions and the impact it has on our financial lives.

1. Facilitating Bank Transfers: Routing numbers are indispensable in electronic funds transfers, playing a crucial role in swiftly transferring funds between different banks. When you wire money to a friend or pay a bill, the routing number ensures the money reaches the correct account, streamlining the entire process.

2. Depositing Checks: When you deposit a check, the routing number informs the bank where the check originated. This allows the bank to process the check quickly and efficiently, ensuring funds are credited to your account promptly.

3. Automated Clearing House (ACH) Transactions: ACH transactions enable recurring payments, such as bill payments or direct deposits, by automatically transferring funds between accounts. Routing numbers are essential for these transactions, ensuring accurate and timely processing.

4. Wire Transfers: For urgent or significant transactions, wire transfers utilize routing numbers to facilitate swift fund transfers to domestic or international accounts.

5. Identifying Banks: Routing numbers act as a distinct identifier for banks within the Federal Reserve System, enabling financial institutions to easily recognize and interact with each other, facilitating seamless transactions.

6. Ensuring Security: Routing numbers reinforce security by ensuring payments reach the correct recipient, minimizing the risk of fraud or misappropriation of funds.

7. Supporting Regional Economic Stability: By providing essential services and fostering financial stability within its region, the Federal Reserve Bank of Atlanta plays a crucial role in promoting economic growth and development.

A Guide to Finding Your Bank’s Routing Number

If you need your bank’s routing number, several options are readily available.

1. Checking Your Bank Statement: Your bank statement typically displays your routing number clearly, often in the top right corner of the document.

2. Visiting Your Bank’s Website: Most bank websites offer a secure online banking portal where you can access your account details, including your routing number.

3. Contacting Your Bank: If you cannot locate your routing number through the previously mentioned methods, you can always contact your bank’s customer service department. They will be able to provide you with the correct routing number.

Federal Reserve Bank Atlanta Routing Number

Navigating the Financial Landscape: Empowering Yourself

Understanding the importance of the Federal Reserve Bank of Atlanta routing number can empower you to navigate the financial landscape with greater confidence. Knowing how these numbers enable smooth transactions and ensure the safety of your funds can make you a more informed and discerning user of the financial system.

By embracing this knowledge, you can not only participate in the financial world with greater understanding but also advocate for a safer and more efficient financial system for all. So, the next time you make a payment, transfer money, or deposit a check, remember the crucial role played by this seemingly simple, yet essential, routing number.

Call to Action: Do you have any questions or experiences related to routing numbers? Share your insights with us in the comments below. Let’s foster a more informed financial community!