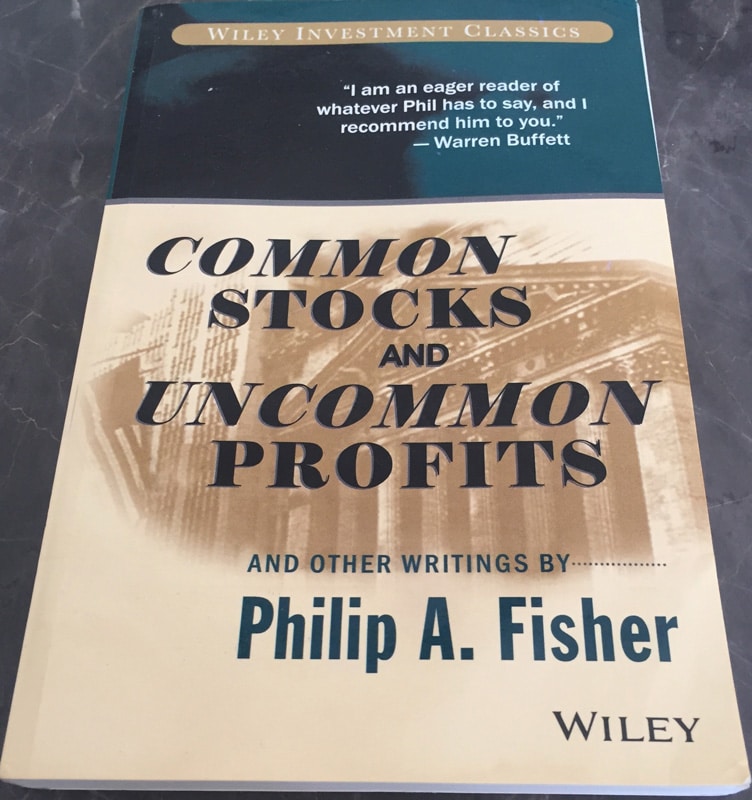

The world of investing can seem daunting, especially for beginners. With countless investment options and ever-changing market conditions, it’s easy to feel overwhelmed. But what if I told you there’s a proven strategy, one that has guided countless investors to success for over six decades? That’s the promise of “Common Stocks and Uncommon Profits,” a timeless masterpiece by Philip A. Fisher, a legendary investor often hailed as one of the “fathers of growth investing.”

Image: shabbir.in

This book, originally published in 1958, is not just a collection of investment principles; it’s a roadmap to achieving financial freedom through a deep understanding of the stock market and its companies. It’s a guide that has stood the test of time, remaining relevant even in today’s digitally driven financial landscape. This article will delve into the essence of “Common Stocks and Uncommon Profits,” exploring its key insights and how they can empower you on your investment journey.

Unlocking the Secrets of Growth Investing

Philip Fisher, a pioneer in growth investing, was a firm believer that long-term success lies in identifying companies with the potential to grow their earnings and market share significantly. He recognized that not every company is suitable for investment, emphasizing the importance of meticulous research and a deep understanding of the business.

Fisher’s approach was refreshingly different from the prevailing Wall Street methods of the era, which often focused on short-term profits and quick gains. He advocated for a patient, long-term strategy, emphasizing the need to identify companies with a competitive edge, robust management, and a commitment to innovation. “Common Stocks and Uncommon Profits” is a comprehensive guide to identifying these hidden gems.

Key Principles of Common Stocks and Uncommon Profits

Fisher’s book is a treasure trove of insightful principles, but here are some of the most impactful:

- Focus on growth: Identify companies with a demonstrable track record of consistent earnings growth and the potential for further expansion.

- Seek out innovative businesses: Companies that embrace innovation and constantly evolve to meet changing market demands are more likely to sustain growth.

- Evaluate management: Invest in companies with strong, ethical, and capable management teams dedicated to long-term value creation.

- Understand the industry: Gain a thorough understanding of the industry in which a company operates, its competitive landscape, and potential future challenges.

- Think long-term: Investing is a marathon, not a sprint. Embrace a patient, long-term approach, holding your investments for years, even decades, if the fundamentals remain strong.

- Conduct thorough research: Don’t rely on hearsay or speculation. Dive deep into a company’s financials, its product portfolio, and future growth prospects.

- Embrace continuous learning: The world of investing is constantly changing. Stay informed about industry developments, new technologies, and market trends.

The Enduring Legacy of “Common Stocks and Uncommon Profits”

The enduring success of Fisher’s work can be attributed to its timeless principles. While the stock market has evolved dramatically since 1958, the fundamentals of business and the principles of sound investment remain the same. Fisher’s emphasis on thorough research, long-term thinking, and understanding the underlying business is as relevant today as it was decades ago.

The book has inspired countless investors, from individual stock market enthusiasts to renowned hedge fund managers. It remains a valuable resource for anyone seeking to navigate the complex world of investing and build a portfolio that delivers sustainable, long-term profits.

![[READ PDF] EPUB Common Stocks and Uncommon Profits and Other Writings ...](https://www.yumpu.com/en/image/facebook/66844305.jpg)

Image: www.yumpu.com

Tips and Strategies from “Common Stocks and Uncommon Profits”

Adopting Fisher’s principles doesn’t require a PhD in finance. You can implement his strategies in your own investing journey, even if you’re a beginner. Here are some practical tips from the book:

- Focus on quality companies: Prioritize companies with a proven track record of growth and strong fundamentals. Avoid chasing hype or investing in companies you don’t fully understand.

- Look for companies with a competitive advantage: Companies that have a distinct edge over their competitors, whether it be a patented technology, unique brand recognition, or an efficient business model, are more likely to thrive.

- Evaluate the management team: Look for leaders who are experienced, ethical, and committed to shareholder value. A strong management team can steer a company through tough times and drive sustained growth.

- Don’t be afraid of small companies: Fisher often found hidden gems in smaller companies with enormous growth potential that larger, established players overlooked.

- Diversify your portfolio: Spread your investments across different sectors and industries to mitigate risk.

Expert Advice for Utilizing Fisher’s Approach

Fisher’s approach might seem simple, but it’s deceptively effective. It requires patience, discipline, and a willingness to invest for the long haul. Remember, long-term success isn’t about maximizing short-term profits but building a portfolio that can weather market fluctuations and generate sustainable returns over time.

Don’t be put off by the complexity of the stock market. With the right guidance and a willingness to learn, you can leverage Fisher’s principles to achieve your financial goals. You can access the book online through various platforms including libraries and book retailers.

FAQ: Understanding the Book and Its Principles

Q: Is “Common Stocks and Uncommon Profits” still relevant in today’s market?

Absolutely. The principles outlined in the book are timeless and apply to any market environment. They focus on the unchanging fundamentals of business, making them enduringly relevant.

Q: Does the book cater to beginner investors?

While the book provides valuable insights for seasoned investors, it’s written in a clear and accessible style that even beginners can grasp. It covers fundamental concepts and provides practical guidance for getting started in the world of investing.

Q: What are the main takeaways from “Common Stocks and Uncommon Profits”?

The book emphasizes the importance of thorough research, long-term thinking, and identifying companies with strong growth potential. It also underscores the role of ethical management and a commitment to innovation in a company’s success.

Q: Where can I find a copy of “Common Stocks and Uncommon Profits”?

The book is available in various formats, including physical copies, e-books, and even audio versions. You can purchase it online through book retailers or borrow it from libraries.

Common Stocks And Uncommon Profits Book Pdf

Conclusion: The Power of Long-Term Investing

“Common Stocks and Uncommon Profits” is not just a book; it’s a philosophy. It’s a philosophy that emphasizes patience, discipline, and the power of long-term thinking in investing. It’s a roadmap that can guide you toward financial success, not through quick fixes but by building a portfolio that delivers enduring value.

Are you interested in learning more about “Common Stocks and Uncommon Profits”? If so, let us know your thoughts. We’d love to hear your questions and insights.