Have you ever stared at a textbook chapter, feeling overwhelmed by a mountain of accounting jargon and perplexing concepts? Maybe you’re wrestling with the intricacies of the accounting equation, or struggling to decipher the nuances of financial statements. Don’t despair! This comprehensive guide will delve into the key takeaways of McGraw Hill Accounting Chapter 2, equipping you with the knowledge and confidence to tackle accounting challenges head-on.

Image: www.studocu.com

Chapter 2 of the McGraw Hill Accounting textbook sets the foundation for understanding the language of business: the language of accounting. It’s like learning a new language, requiring you to understand the basic vocabulary, grammar, and sentence structure. This chapter equips you with the essential building blocks you’ll need to comprehend financial information and make informed business decisions.

Understanding the Heart of Accounting: The Accounting Equation

The Fundamental Building Block

At the core of accounting lies the accounting equation, a simple yet powerful formula that encapsulates the relationship between a company’s assets, liabilities, and equity. Think of it as a balance scale: what a company owns (assets) must equal what it owes to others (liabilities) plus the value of its owners’ investment (equity).

Breaking Down the Components

- Assets: Resources owned by the company that have future economic benefit. Think of assets as the company’s “toolbox” – cash on hand, equipment, inventory, and even intangible assets like patents and trademarks.

- Liabilities: Obligations that the company owes to others. These are the company’s “debts” – things like loans, accounts payable, and salaries owed to employees.

- Equity: The owners’ claim on the company’s assets. It represents the residual value of the company after all debts are paid. Think of equity as the owners’ “investment” in the business.

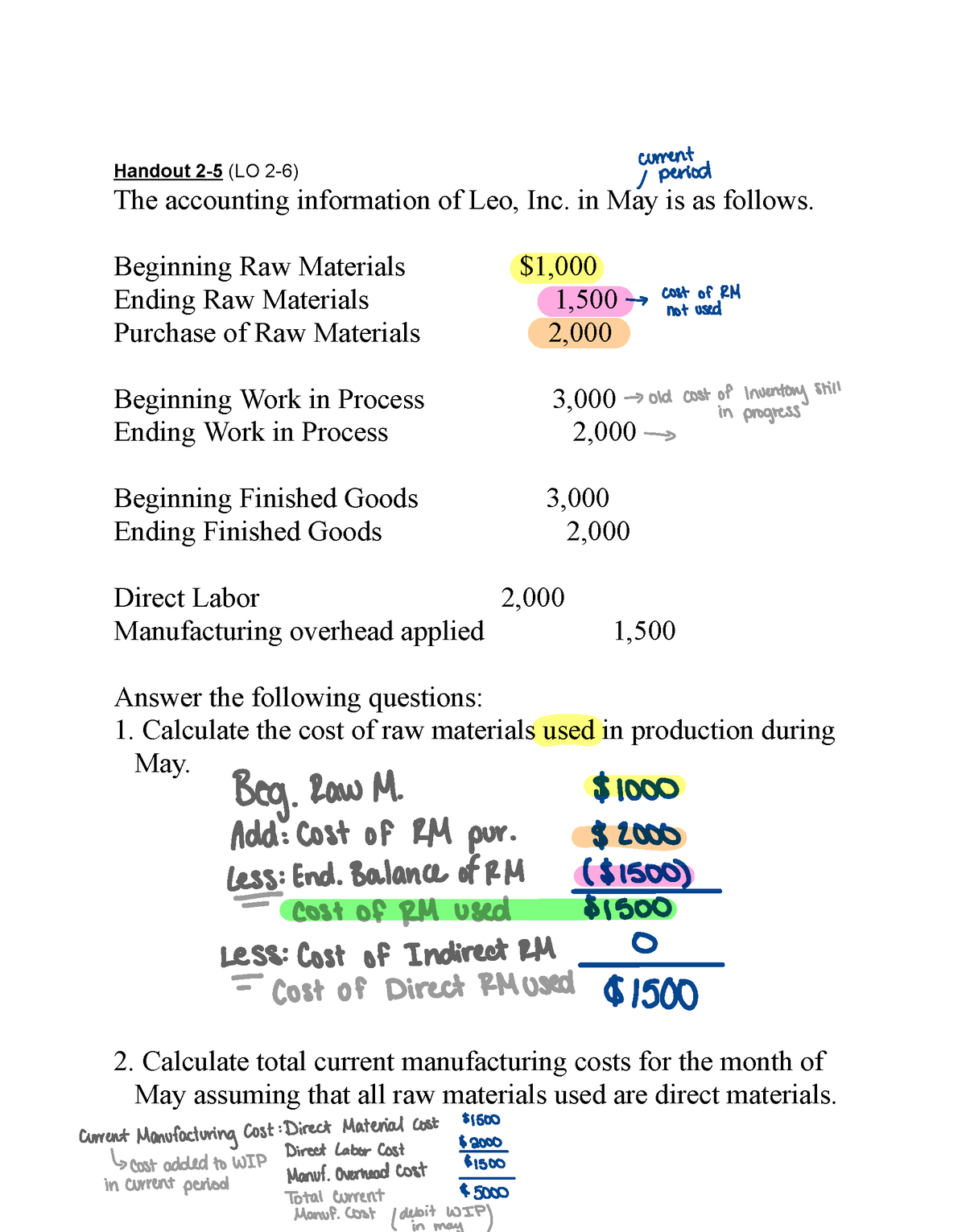

Image: www.studocu.com

The Accounting Equation in Action

Let’s consider a simple example. Imagine a small bakery that owns a building worth $100,000, has $50,000 in cash, and owes $20,000 on a loan. The accounting equation would look like this:

Assets ($100,000 + $50,000) = Liabilities ($20,000) + Equity ($130,000)

Unveiling the Financial Statements: The Language of Business

A Glimpse into the Company’s Health

Financial statements are the primary language of business, providing insights into a company’s financial performance and position. Think of them as the “report card” that summarizes a company’s financial activities, allowing investors, creditors, and managers to make informed decisions.

The Big Three: Balance Sheet, Income Statement, Statement of Cash Flows

- Balance Sheet: A snapshot of a company’s financial position at a specific point in time. It reflects the company’s assets, liabilities, and equity, providing insights into its financial health, liquidity, and solvency.

- Income Statement: A summary of a company’s revenues and expenses over a specific period. This reveals a company’s profitability and tells the story of its operating performance.

- Statement of Cash Flows: A report that tracks the movement of cash into and out of a company during a specific period. This statement provides valuable information about the company’s ability to generate cash, pay its debts, and fund its operations.

The Significance of Accounting Conventions: Ensuring Consistency and Transparency

General Accepted Accounting Principles (GAAP)

Accounting isn’t purely arbitrary; it adheres to a set of guidelines known as Generally Accepted Accounting Principles (GAAP). This framework ensures consistency and transparency in financial reporting, allowing companies to communicate financial information in a standardized manner, making it easier for stakeholders to compare and understand financial data across different companies.

The Key Principles: Ensuring Meaningful Financial Statements

- Going Concern: The assumption that a company will continue to operate for the foreseeable future, enabling accounting to assume a company’s long-term viability and not be wound up.

- Matching Principle: This principle dictates that revenues and expenses should be matched in the same accounting period, creating a clear and accurate representation of a company’s profitability.

- Historical Cost: This principle emphasizes recording assets and liabilities at their original purchase price, providing a historical perspective and avoiding subjective valuations.

Real-World Applications: Accounting in Action

From Small Businesses to Large Corporations

Accounting isn’t just a theoretical subject; it’s a vital tool for businesses of all sizes, from small startups to multinational corporations. It plays a crucial role in:

- Financial Reporting: Providing investors, creditors, and other stakeholders with transparent and reliable financial information.

- Decision Making: Supporting managers in making informed decisions about resource allocation, pricing, and investment strategies.

- Tax Compliance: Ensuring that a company complies with tax regulations and accurately calculates its tax liabilities.

- Internal Control: Implementing systems to prevent fraud, errors, and inefficiencies.

Navigating the Complexities: Essential Resources and Tips

Chapter 2 of the McGraw Hill Accounting textbook provides a solid foundation, but mastering accounting requires ongoing learning and practice. Here are some valuable resources and tips to help you succeed:

- Utilize Online Resources: Numerous online resources, like Khan Academy, provide free accounting lessons, tutorials, and practice exercises.

- Engage in Active Learning: Don’t just passively read the textbook. Take notes, try solving practice problems, and ask your instructor or classmates for clarification.

- Apply Concepts to Real-World Examples: Pay attention to accounting news and financial reports from real companies. See how the concepts you’re learning are applied in practice.

Mcgraw Hill Accounting Chapter 2 Answers

Conclusion: Building a Solid Foundation for Accounting Success

Understanding the fundamentals laid out in McGraw Hill Accounting Chapter 2 is essential for anyone seeking to grasp the language of business. Armed with knowledge of the accounting equation, financial statements, and key accounting conventions, you are well-equipped to navigate the world of accounting with confidence. Remember to practice, explore resources, and apply what you’ve learned to the real world. By doing so, you’ll unlock the power of accounting and its ability to guide you toward smart business decisions.