Imagine this: you’re finally ready to buy your dream home, but the bank tells you your loan application is being denied. The reason? Too many hard inquiries on your credit report. You’re frustrated, confused, and unsure where to turn. You didn’t even realize those credit inquiries were there! This scenario is all too common, and a stressful experience. But don’t despair! You can take control of your credit and start removing those inquiries that are impacting your financial future.

Image: cashier.mijndomein.nl

This guide will walk you through the process of removing inquiries from your credit report, equip you with a sample letter you can use, and empower you to take action! Understanding how inquiries work is the first step towards a clean credit report and a brighter financial future.

What Are Credit Inquiries?

A credit inquiry is a request from a lender or other entity to access your credit report. When you apply for a loan, a credit card, or even a new utility service, the provider checks your credit history to assess your risk. These inquiries, though seemingly small, can have a significant impact on your credit score.

Hard Inquiries vs. Soft Inquiries

It’s important to distinguish between the two types of inquiries:

- Hard Inquiries: These inquiries impact your credit score and are usually made when you apply for credit. They remain on your report for two years.

- Soft Inquiries: These inquiries typically don’t affect your credit score. They are often made when you check your own credit report, a potential employer requests your credit information, or when you’re pre-approved for a credit card.**

It’s those hard inquiries, triggered by credit applications, that you need to focus on removing.

How Can Credit Inquiries Impact You?

Hard inquiries can impact your credit score for a couple of key reasons:

- Multiple inquiries signal potential credit risk: When lenders see numerous inquiries, they often assume the borrower is shopping for credit, which can be a sign of financial insecurity.

- Inquiries can lower your credit score: The impact of a hard inquiry on your score varies depending on individual credit factors, but the general effect is a slight decrease.

While one inquiry may not severely damage your credit score, multiple inquiries can quickly decrease your score and potentially hinder your ability to secure loans, rent an apartment, or even get the best interest rates.

Image: templates.hilarious.edu.np

Why Should You Remove Inquiries from Your Credit Report?

Removing inaccurate or unnecessary inquiries allows you to take back control over your credit health. Why is this so important?

- A higher credit score: By removing inquiries, you’ll see your score improve, opening the door to better financing options and potentially lower interest rates.

- Increased financial opportunity: A better credit score makes you a more attractive borrower, giving you access to better loan terms, credit cards, and even a wider selection of apartments or houses.

- Easier access to credit: With a higher credit score, you’ll have a better chance of getting approved for credit and loans.

- Peace of mind: Knowing that your credit report is accurate and reflects your true creditworthiness can bring peace of mind and financial stability.

Understanding Your Rights

- The Fair Credit Reporting Act (FCRA): You have rights under the FCRA, which empowers you to request a free copy of your credit report annually from each credit bureau (Equifax, Experian, and TransUnion).

- Dispute inaccurate information: The FCRA also gives you the right to dispute any inaccurate or unverifiable information on your credit report, including inquiries.

How to Remove Inquiries from Your Credit Report

Here’s a step-by-step guide to remove those unwanted inquiries:

- Get your credit report: Obtain free copies from each of the three major credit bureaus.

- Identify the inquiries you want to remove: carefully review each report and note any inquiries that are inaccurate, unverifiable, or you did not authorize.

- File a dispute: Contact each credit bureau and formally dispute the inaccurate inquiries. You can do this online, by phone, or by mail.

- Write a dispute letter: A carefully crafted dispute letter can greatly increase your chances of success.

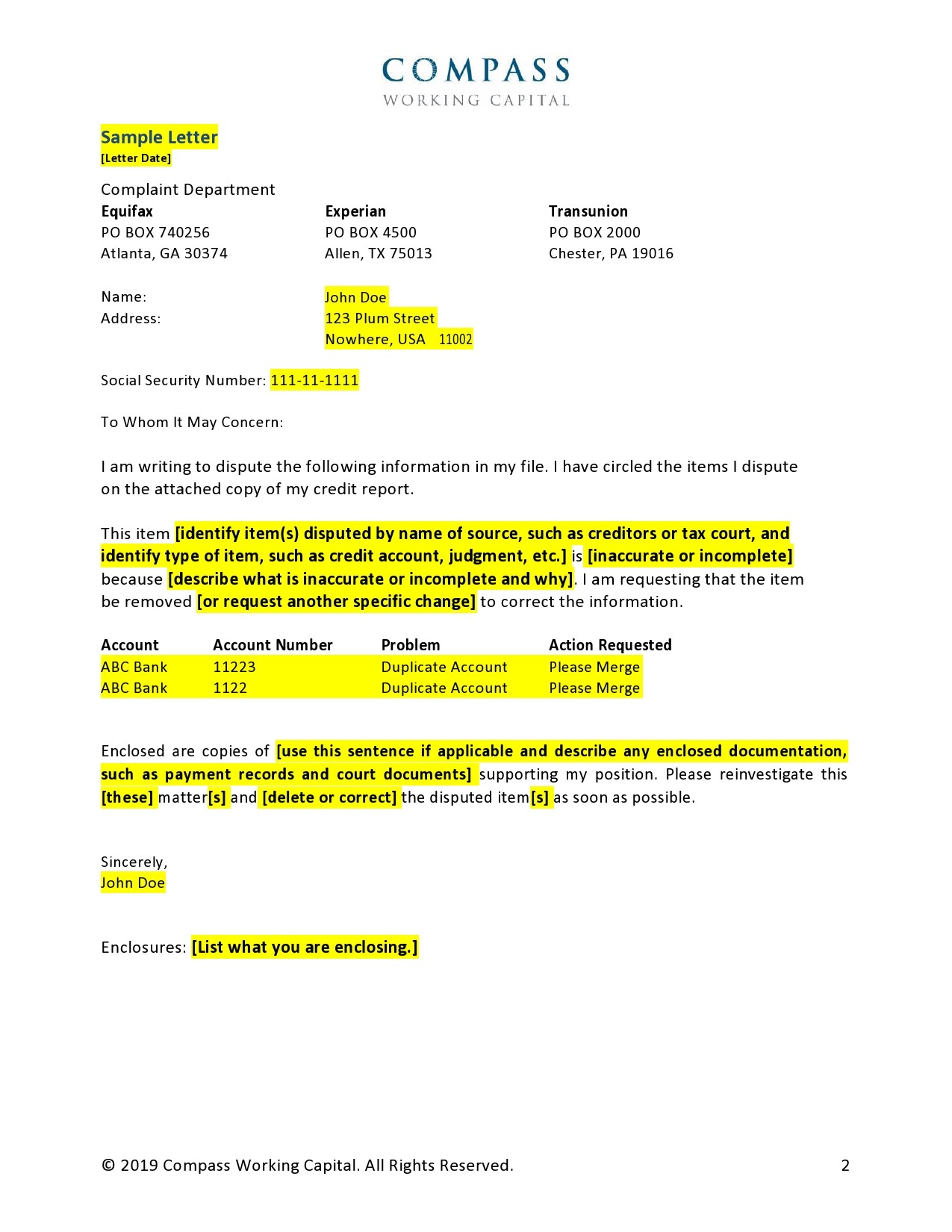

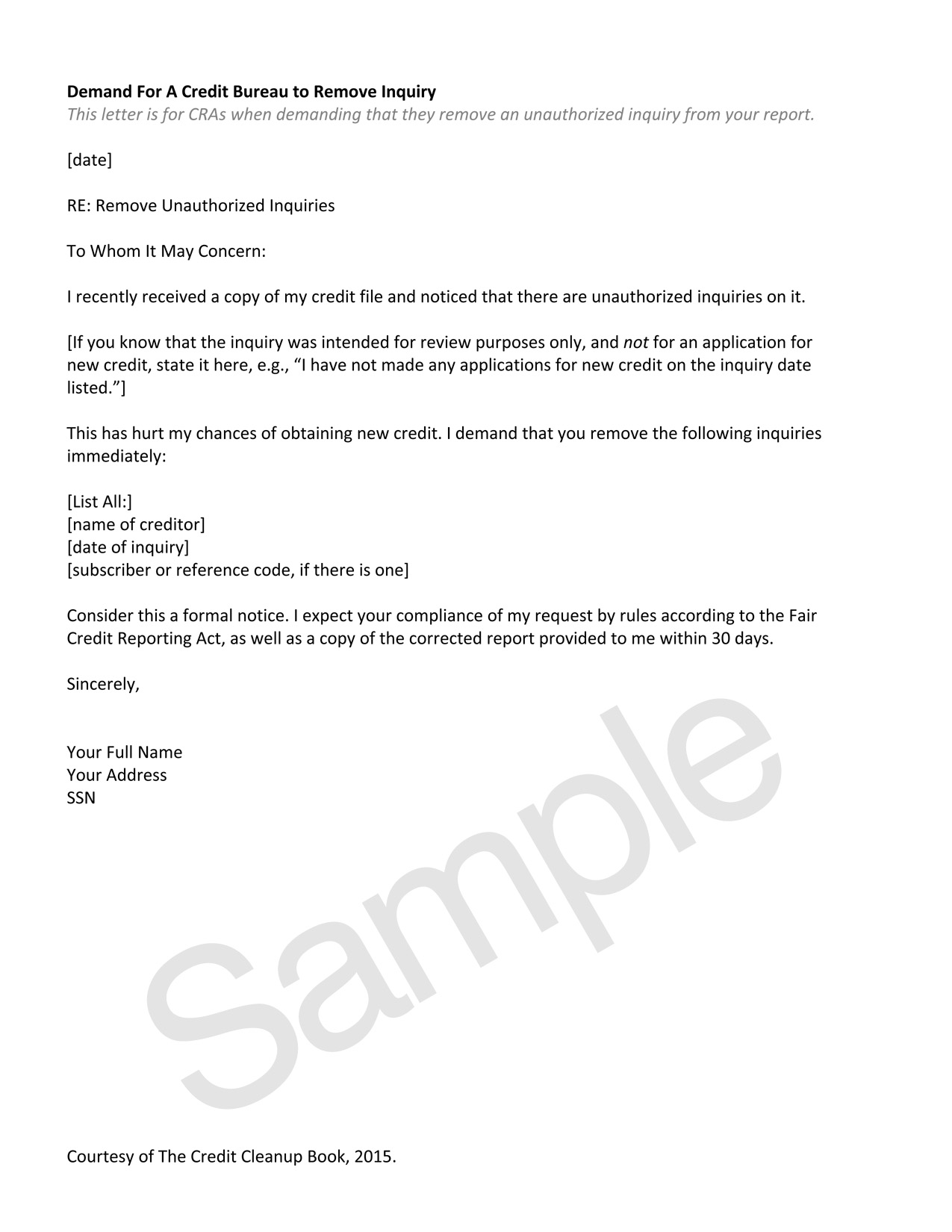

Sample Letter to Dispute Inquiries

Here’s a sample letter that you can use to dispute inquiries:

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Credit Bureau Name]

[Credit Bureau Address]

RE: Dispute of Inaccurate Credit Inquiry

Dear [Credit Bureau Name],

I am writing to dispute an inaccurate inquiry listed on my credit report. The inquiry, dated [Date of Inquiry], from [Name of Company] with account number [Account Number] is not authorized and should be removed.

I have never applied for credit or any other service with [Name of Company] on the date indicated. I have reviewed my credit card statements and other financial records, and I can confirm that this inquiry is not related to any legitimate transactions.

Please investigate this matter immediately and remove the unauthorized inquiry from my credit report.

I request a copy of any documentation related to this inquiry, including the original request for information, and any verification process conducted by [Name of Company].

Thank you for your prompt attention to this matter. Please contact me at [Your Phone Number] or [Your Email Address] if any further information is required.

Sincerely,

[Your Name]

Supporting Documentation

Include any supporting documentation that can strengthen your claim:

- Copies of your recent credit card statements

- Bank statements

- Any correspondence from the company related to the disputed inquiry

What Happens After You Dispute the Inquiry?

- Within 30 days: The credit bureau must investigate your dispute and respond. They’ll either correct the information or provide you with an explanation as to why they won’t.

- If the inquiry is not removed: You can continue to dispute it with the credit bureau or contact the company directly and request they remove the inquiry.

Additional Tips for Removing Inquiries from Your Credit Report

- Be persistent: If the credit bureau doesn’t remove the inquiry, you may need to follow up repeatedly.

- Consider credit monitoring services: These services can alert you to any changes in your credit report, allowing you to catch potential errors early and take action to correct them.

- Keep a record of your efforts: Document all communication with the credit bureaus and companies involved.

How To Remove Inquiries From Credit Report Sample Letter

Conclusion

Taking steps to remove inaccurate inquiries from your credit report is a crucial step towards achieving a healthy credit score. The process can be challenging, but remember, you have rights, and you can empower yourself to make a positive impact on your financial well-being. By understanding the process, utilizing sample letters like the one provided, and remaining persistent in your efforts, you can reclaim control of your credit and secure a brighter financial future. Remember, a clean credit report is a solid foundation for your financial success.