Have you ever wondered how money moves between banks, across cities, and even across the globe? It’s a complex process, but at its core lies a simple, but crucial, element: the Federal Reserve Bank Routing Number, often called the routing number. Every bank in the United States has one, and these numbers are essential for ensuring that your money gets to where it needs to go.

Image: classroom.synonym.com

But understanding routing numbers goes beyond simply knowing what they are. It’s about appreciating their role within our financial system, how they affect you directly, and how you can harness this knowledge for a smoother financial journey. Let’s dive into the fascinating world of these seemingly simple, but deeply important, numbers.

Demystifying the Federal Reserve Bank Routing Number

A Federal Reserve Bank Routing Number, also known as a routing transit number (RTN), is a 9-digit code used by financial institutions to identify a specific bank or financial institution. It acts as a unique identifier for each bank, much like a zip code pinpoints a specific location. Every bank in the United States has one, and it’s a critical element in the processing of checks, electronic transfers and other financial transactions.

Think of it this way: When you write a check, the routing number tells the bank where to send your money. Similarly, when you make an online transfer, the routing number helps ensure your money arrives at the correct destination. In essence, it’s like a passport, allowing funds to travel seamlessly across the US financial network.

The Structure and Significance of a Routing Number

A routing number might seem like a random sequence of numbers, but each digit holds a specific meaning:

- First Four Digits: These numbers represent the specific Federal Reserve Bank district the bank belongs to. The United States is divided into twelve Federal Reserve Districts, each with its own bank.

- Fifth and Sixth Digits: These digits indicate the bank’s individual identification number within that specific district.

- Seventh and Eighth Digits: These digits, generally “00,” reflect the type of bank.

- Ninth Digit: This digit acts as a check digit, used for detecting errors and ensuring accurate processing.

Beyond the individual digits, a routing number is significant for several reasons:

- Facilitates Safe and Efficient Transfers: It ensures that funds are transferred accurately and securely between banks, individuals, and businesses.

- Enables Automating Financial Processes: It allows for automated payments, transfers, and reconciliation, making financial processes more efficient.

- Simplifies International Transactions: When dealing with international transactions, routing numbers help facilitate smooth cross-border payments.

Finding Your Bank’s Routing Number

Knowing your bank’s routing number is crucial for various financial activities. Fortunately, it’s readily accessible:

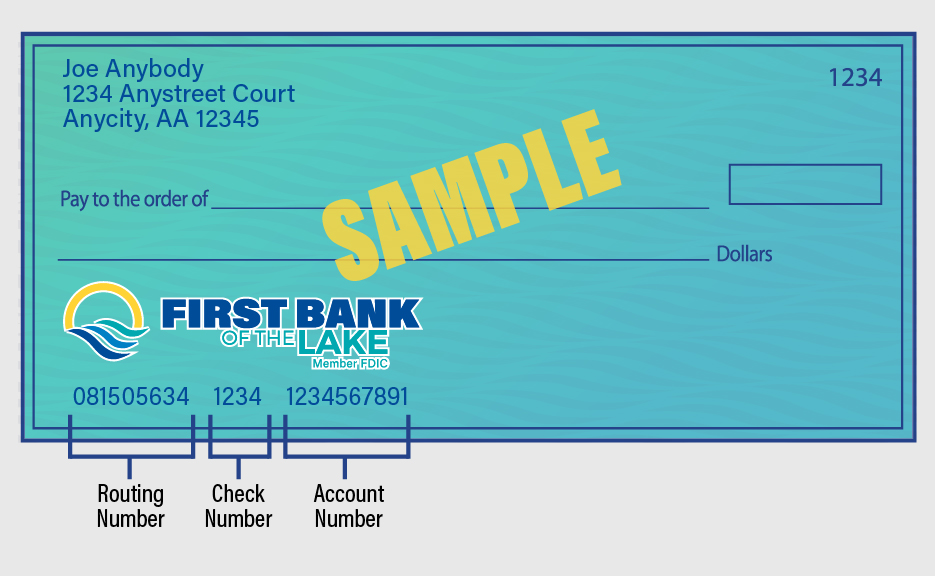

- Checkbook: Look for the routing number printed at the bottom of your check.

- Bank Statement: It’s typically listed alongside your account information.

- Bank Website: Most banks display routing numbers on their websites, often under “account information” or “customer service.”

- Contacting Your Bank: Feel free to call or visit your bank branch and ask for your routing number.

Image: www.victoriana.com

Common Uses of Routing Numbers

Routing numbers are crucial in various financial transactions, including:

- Check Processing: When you write a check, the payer’s bank uses the provided routing number to identify the payee’s bank and process the transaction.

- Electronic Transfers: Online banking, bill payments, and wire transfers all rely on routing numbers to direct funds to the appropriate destination.

- Direct Deposit: Employers use your routing number to deposit your paycheck directly into your bank account.

- ACH Transfers: Automated Clearing House (ACH) transfers, which are commonly used for recurring payments, also utilize routing numbers.

The Importance of Accuracy: Mistakes and Consequences

Using the correct routing number is absolutely critical. Errors can lead to delayed payments or even your money going to the wrong account.

- Incorrect Routing Number Leads to Delays: If you use the wrong routing number, your transaction might be delayed while your bank attempts to locate the correct recipient.

- Money Arriving in the Wrong Account: In extreme instances, your payment might be processed and sent to a completely different account, potentially causing financial distress.

Tips for Using and Protecting Your Routing Number

- Double-check Numbers Before Processing Transactions: Carefully verify the routing number whenever you make a payment, transfer funds, or set up a direct deposit.

- Avoid Sharing Your Routing Number Unnecessarily: Keep your routing number secure and share it only with trusted parties, such as your employer or financial institutions.

- Monitor Your Account for Suspicious Activity: Regularly check your bank account for unauthorized transactions, as this could indicate misuse of your routing number.

- Report Any Issues Immediately: If you suspect your routing number has been compromised, contact your bank immediately to report the incident and take appropriate steps to protect your accounts.

The Future of Routing Numbers

As technology advances, the use of routing numbers is evolving. They are becoming more integrated with newer digital payment systems, streamlining the process of moving money. This evolution may lead to new security protocols and advancements in how routing numbers are used, even as their core function remains vital for our financial system.

List Of Federal Reserve Bank Routing Numbers

Conclusion

The Federal Reserve Bank Routing Number is a silent, but essential, player in our financial system. Understanding its function empowers you to manage your finances more efficiently and securely. Remember to prioritize accuracy when using these numbers, keeping them secure and monitoring your accounts for any unusual activity. With this knowledge, you can navigate the world of banking with greater confidence, knowing that your money is flowing where it needs to go, thanks to the vital role these seemingly simple numbers play.