Have you ever received a seemingly innocuous letter from your bank only to be thrown into a frenzy of worry and confusion? A change in account details, a new payment method, or an update to the terms and conditions can be alarming, especially if you’re not aware of the reason behind the change. Thankfully, keeping your customers informed is a crucial aspect of maintaining trust and building long-lasting relationships. But where do you even begin?

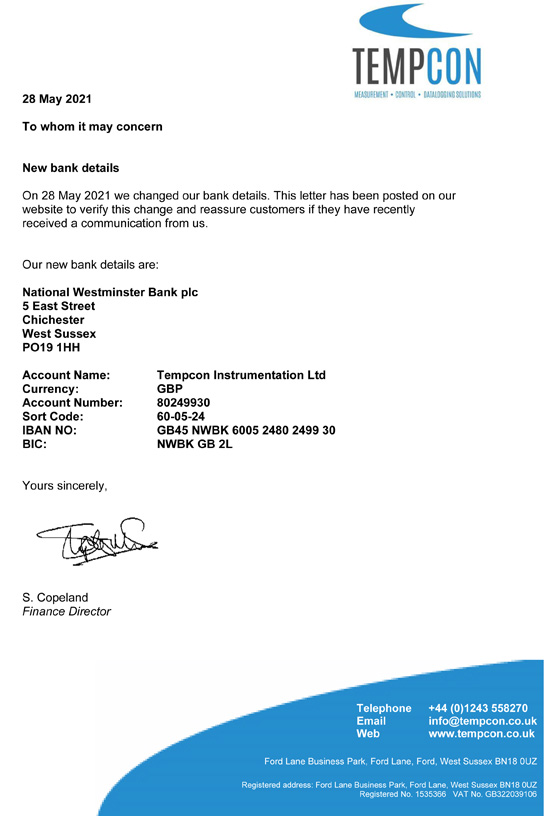

Image: www.tempcon.co.uk

Enter the notice sample letter. This seemingly simple document plays a crucial role in navigating these potentially sensitive situations by providing clear and concise information about changes affecting your customers’ financial lives. Whether you’re a small business owner or a large financial institution, understanding how to craft an effective notice letter is essential for maintaining transparency, avoiding confusion, and ensuring a smooth transition. Let’s delve into the art of communication and learn how to draft a notice letter that fosters understanding and builds trust.

Understanding the Purpose of a Notice Sample Letter

Imagine you’re a customer who suddenly finds an unfamiliar bank account number listed in your online banking statement. You might be taken aback, wondering if your account has been hacked or compromised. This is the exact scenario a notice sample letter aims to prevent. A well-crafted notice letter acts like a bridge, ensuring customers are aware of any changes beforehand, leading to minimized anxiety and confusion.

But it goes beyond simply informing customers. A notice letter is an opportunity to demonstrate your transparency and commitment to building a trustworthy relationship. It allows you to explain the rationale behind the change, addressing any concerns customers might have. Providing details about how the change impacts them, the timelines involved, and the steps they need to take to adapt can go a long way in reassuring them and ensuring a smooth transition.

Crafting a Notice Sample Letter: A Step-by-Step Guide

Now that we understand the purpose, let’s explore the nitty-gritty of crafting a notice letter. It’s all about creating a clear and concise document that delivers the essential information. Here’s a step-by-step guide you can use:

1. Start with a Professional and Friendly Heading

The header is your first impression, and it should exude professionalism and be inviting. Avoid generic phrases like “Important Notice” and instead opt for something that’s clear, engaging, and relevant to the specific change. For example, if you’re changing your bank account number for easier processing, you can use:

“Notice: Important Update Regarding Your Account Number”

Image: www.pinterest.com.au

2. Clearly State the Purpose of the Letter

Right off the bat, introduce the central reason for the notice letter. This should be a concise and clear statement that addresses the specific change. For instance:

“This letter is to inform you about an upcoming change to our bank account details, effective [date].”

3. Provide a Clear and Concise Explanation of the Change

Now comes the crucial part – explaining the reason for the change. Be specific about the change itself, the date it comes into effect, and how it impacts the customer’s account. Don’t use technical jargon or overly complex language. Remember, you’re aiming for clarity, not confusion.

For example, if you’re changing your bank account number for improved security, you can state:

“We are changing our bank account number to [new account number] to enhance the security and efficiency of our financial transactions.”

4. Describe the Impact of the Change on Customers

Acknowledge the change’s potential impact on customers. This section involves clarifying how the change affects their everyday interactions with your bank, such as:

- How to make future payments: “All future payments should be made using the new account number [new account number].”

- How to update existing payment information: “You may need to update your payment information for recurring bills or subscriptions with the new bank account number.”

- Any potential disruptions: “We understand this change might require some adjustments, and we appreciate your patience during this transition.”

5. Include Clear and Actionable Steps

If the change requires customers to take specific actions, outline them clearly. These could involve updates to their online banking profiles, changing automatic payments, or contacting customer service for assistance. Provide relevant contact information and resources.

For example:

- “To update your payment information for recurring bills, please visit our website at [website address] or call our customer service line at [phone number].”

6. Offer Assistance and Contact Information

Assuring customers you’re there to support them during the transition is crucial. Provide clear contact information for customer service, online resources, and any relevant FAQs. You can also include a helpline number for customers who might have specific queries.

For instance:

- “If you have any questions about this change, please don’t hesitate to contact our customer service team at [phone number] or visit our website at [website address] for FAQs and additional information.”

7. Conclude with a Professional Closing

End the letter with a courteous and professional closing, expressing gratitude for your customers’ understanding and ongoing trust.

For example:

- “Thank you for your understanding and continued confidence in [bank’s name]. We are committed to providing you with exceptional banking services.”

Examples of Notice Sample Letter for Different Situations

To make this even more practical, let’s look at a few examples of notice letters based on different situations:

Sample Notice Letter for Bank Account Number Change

[Your Bank’s Name]

[Your Bank’s Address]

[Your Bank’s Phone Number]

[Your Bank’s Email Address]

[Date]

[Customer’s Name]

[Customer’s Address]

Dear [Customer’s Name],

Notice: Important Update Regarding Your Account Number

This letter is to inform you about an upcoming change to our bank account details, effective [date]. We are changing our bank account number to [new account number] to enhance the security and efficiency of our financial transactions.

This change will affect all future payments made to our bank. All future payments should be made using the new account number [new account number]. You may need to update your payment information for recurring bills or subscriptions with the new bank account number.

We understand this change might require some adjustments, and we appreciate your patience during this transition. Please note that our old account number will be active temporarily until [date] to ensure a smooth transition.

To update your payment information for recurring bills, please visit our website at [website address] or call our customer service line at [phone number]. If you have any questions about this change, please don’t hesitate to contact our customer service team at [phone number] or visit our website at [website address] for FAQs and additional information.

Thank you for your understanding and continued confidence in [bank’s name]. We are committed to providing you with exceptional banking services.

Sincerely,

[Your Bank’s Name]

Sample Notice Letter for Branch Closure

[Your Bank’s Name]

[Your Bank’s Address]

[Your Bank’s Phone Number]

[Your Bank’s Email Address]

[Date]

[Customer’s Name]

[Customer’s Address]

Dear [Customer’s Name],

Notice: Upcoming Closure of [Branch Name] Branch

This letter is to inform you about the upcoming closure of our [Branch Name] branch, effective [date]. This decision was made after careful consideration to streamline our operations and provide more convenient and efficient banking services to our customers.

We understand this closure may result in some inconvenience, and we sincerely apologize for any disruption it might cause. We are committed to ensuring a smooth transition for our valued customers.

All banking services, including account access, deposits, withdrawals, and loan payments, can be conveniently accessed at our other branches located at [List nearby branch locations] or through our digital banking platforms.

You can continue accessing your account online through our website [website address] or mobile banking app available on [App Store/Google Play Store]. You can also contact our customer service line at [phone number] for assistance or to schedule an appointment at one of our nearby branches.

We want to assure you that your account will remain unaffected by this branch closure, and your banking experience with us will remain seamless.

Thank you for your understanding and continued confidence in [bank’s name]. We look forward to continuing to serve you.

Sincerely,

[Your Bank’s Name]

Sample Notice Letter for New Fee Structure

[Your Bank’s Name]

[Your Bank’s Address]

[Your Bank’s Phone Number]

[Your Bank’s Email Address]

[Date]

[Customer’s Name]

[Customer’s Address]

Dear [Customer’s Name],

Notice: Update Regarding Our Fee Structure

This letter is to inform you about an upcoming change to our fee structure, effective [date]. We are updating our fee schedule to reflect changes in the banking industry and to ensure the ongoing sustainability of our services.

This update includes [Briefly explain the specific fee changes, such as new fees, increased fees, or changes in fee calculation]. We understand that fee changes might raise questions, and we are committed to transparency in our communication.

A detailed breakdown of the updated fee structure is available on our website at [website address] and will also be included in your next statement.

We believe these changes will allow us to continue providing you with the highest level of service and financial security.

If you have any questions or concerns regarding these updates, please don’t hesitate to contact our customer service team at [phone number] or visit our website at [website address] for FAQs and additional information.

We appreciate your continued patronage and trust.

Sincerely,

[Your Bank’s Name]

Expert Insights and Actionable Tips for Effective Notice Letters

While notice letters might seem like a mere formality, it’s a critical tool for establishing trust and cultivating strong customer relationships. Here are some expert insights for crafting notice letters that effectively convey information and build a positive connection:

- Keep it Concise and Straightforward: Avoid using jargon or overly complex language. Remember, the goal is for customers to understand the change clearly.

- Focus on the Customer’s Perspective: Empathize with the customer’s potential concerns and consider how the change might affect their everyday lives.

- Be Respectful and Professional: Use a courteous and professional tone throughout the letter, demonstrating that you value your customers’ time and trust.

- Offer Support and Resources: Provide clear contact information and resources to assist customers in understanding the change and navigating the transition.

- Be Transparent and Honest: Transparency is key to building trust. Be clear about the reason for the change, and don’t try to hide anything.

- Tailor the Letter to Each Situation: For example, a notice letter for a branch closure will be significantly different from a notice letter for a change in fee structure.

Notice Sample Letter Informing Customers Of Change In Bank Account

Conclusion: The Power of Clear Communication

A well-crafted notice sample letter is much more than just a notification; it’s a cornerstone of maintaining transparency, fostering trust, and ensuring a smooth transition for your customers. It signifies your commitment to open and honest communication, allowing you to navigate changes with grace and build lasting relationships. Remember to be proactive, clear, and empathetic, providing all necessary information to empower your customers to make informed decisions and confidently embrace the change. By mastering the art of clear communication, you can build a strong foundation of trust with your customers, paving the way for a stronger and more fulfilling financial journey together.