Imagine you’re looking to invest in a new company. You hear promising whispers about its potential and see its stock price soaring. Excited, you delve into its financial reports, hoping to understand its true worth. But imagine your disappointment when you discover the reports are incomplete, leaving key details shrouded in mystery. It’s like trying to assemble a puzzle with missing pieces; you can’t form a clear picture of the company’s financial health. This is the danger of incomplete financial reporting: it erodes trust and hinders informed decision-making.

Image: www.studocu.com

The principle of “all relevant information should be included in financial reports” is far more than a mere accounting formality; it’s the bedrock of financial transparency. This principle ensures that investors, creditors, and other stakeholders have access to a comprehensive and accurate picture of a company’s financial status, allowing them to make informed judgments and decisions.

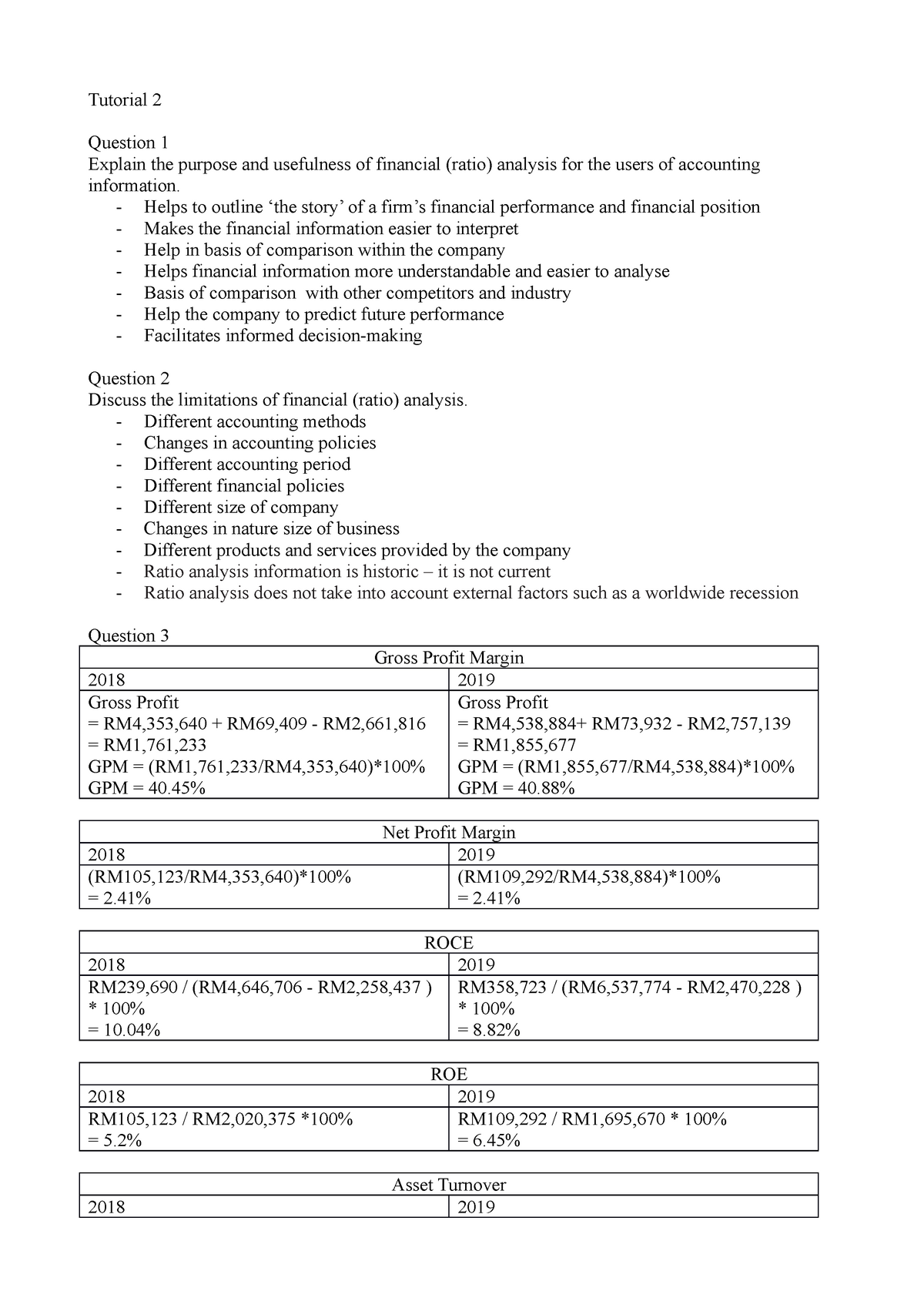

The Importance of Comprehensive Financial Reporting

Financial reports serve as the primary communication channel between a company and its stakeholders. They provide a snapshot of the company’s financial health, outlining its revenues, expenses, assets, liabilities, and cash flows. When reports are incomplete, they create blind spots, preventing stakeholders from fully understanding the company’s true position.

Transparency cultivates trust, a cornerstone of any successful business relationship. When stakeholders have confidence in the accuracy and completeness of financial reports, they are more likely to support the company through investments, loans, and other transactions. Conversely, incomplete reporting breeds suspicion and mistrust, potentially leading to financial instability and a loss of confidence in the company.

What Makes a Financial Report Complete?

Beyond the Basics: Understanding the Spectrum of Relevant Information

The exact content of a complete financial report varies depending on the company’s size, industry, and regulatory environment. However, some fundamental elements are common across the board. These include:

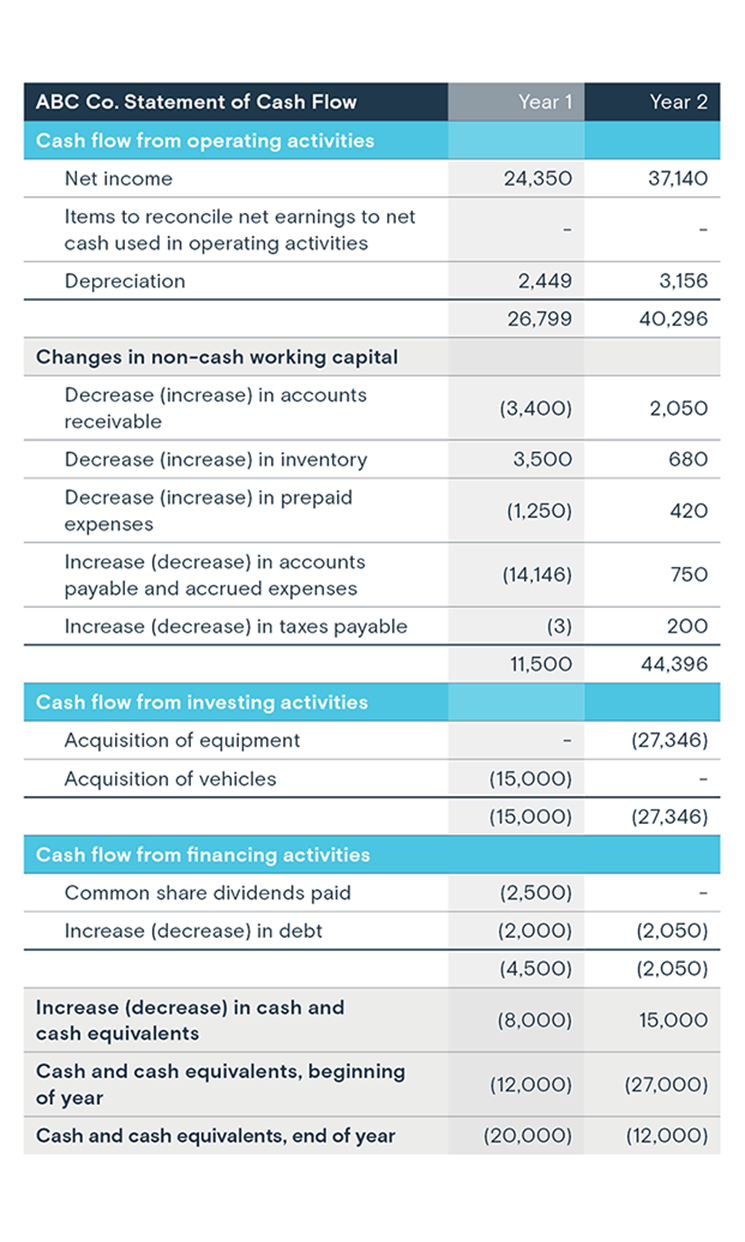

- Financial Statements: The core of any financial report, consisting of the balance sheet, income statement, and cash flow statement.

- Notes to the Financial Statements: These provide detailed explanations of accounting policies, assumptions, and significant events that impact the financial statements.

- Management’s Discussion and Analysis (MD&A): This section offers management’s insights into the company’s financial performance and future prospects, highlighting key trends and risks.

- Auditors’ Report: In most cases, an independent auditor provides an opinion on the fairness and accuracy of the financial statements.

- Financial Ratios: These calculations provide a deeper understanding of the company’s financial health by comparing various elements of its financial statements.

Image: ar.inspiredpencil.com

Beyond the Quantitative: Shining a Light on Non-Financial Information

While quantitative data is essential, a complete financial report needs to go beyond just numbers. It should also include:

- Sustainability Reports: Companies are increasingly expected to disclose their environmental and social impacts, demonstrating their commitment to responsible business practices.

- Risk Factors: Companies should openly discuss the risks they face, offering investors a clear understanding of potential challenges and uncertainties.

- Compensation Information: Transparency regarding executive compensation packages and employee benefits fosters trust and fairness.

- Governance Practices: Clear communication about corporate governance structures and processes ensures accountability and ethical decision-making.

The Latest Trends in Financial Reporting

The landscape of financial reporting is constantly evolving, driven by technological advancements, regulatory changes, and investor expectations. Some key trends include:

- Increased Use of Data and Analytics: Companies are leveraging data analytics to provide more insightful financial information, enriching their reports with predictive insights and detailed analysis.

- Focus on Sustainability Reporting: As environmental and social concerns rise, companies are increasingly adopting sustainability reporting frameworks, integrating non-financial data into their financial reports.

- Rise of XBRL and Other Electronic Filing Formats: Electronic reporting formats like XBRL (Extensible Business Reporting Language) streamline the process of collecting, analyzing, and disseminating financial information, promoting greater efficiency and accuracy.

- Growing Demand for Real-Time Disclosure: Investors are increasingly demanding more frequent updates on companies’ performance, leading to an increased emphasis on real-time disclosure and transparency.

Expert Tips for Enhancing Financial Reporting Transparency

Even experienced financial professionals can benefit from ongoing refinement of their reporting practices. Consider implementing these tips:

- Establish a Clear Disclosure Policy: Clearly define what information will be disclosed and how it will be communicated to stakeholders.

- Engage with Stakeholders: Regularly seek feedback from investors, analysts, and other stakeholders on the comprehensiveness and usefulness of your financial reports.

- Invest in Technology: Utilize software and tools that leverage data analytics and automation to improve the efficiency and accuracy of reporting.

- Embrace Sustainability Reporting: Integrate your environmental and social performance data into your financial reports, demonstrating your commitment to sustainability.

- Stay Updated on Regulatory Trends: Keep abreast of evolving regulatory requirements and best practices in financial reporting to ensure compliance and maintain stakeholder trust.

By embracing these practices, companies can foster a culture of transparency, leading to stronger relationships with stakeholders, enhanced investor confidence, and ultimately, greater long-term stability and success.

FAQ:

Q: Why is it so important for financial reports to be accurate?

A: Inaccurate financial reports can mislead investors, creditors, and other stakeholders, leading to poor decision-making and potentially disastrous outcomes. Accuracy is crucial for maintaining trust and fostering a strong financial foundation.

Q: What are some of the consequences of incomplete financial reporting?

A: Incomplete reporting can lead to reduced investor confidence, difficulty in obtaining loans, reputational damage, and even legal repercussions. It’s vital to provide a comprehensive picture of a company’s financial health.

Q: Can technology help improve the completeness of financial reports?

A: Yes, absolutely! Data analytics, automation tools, and electronic filing formats like XBRL can significantly enhance the efficiency and accuracy of financial reporting. These technologies can help ensure that all relevant information is included and presented in a clear and concise manner.

All Relevant Information Should Be Included In The Financial Reports

https://youtube.com/watch?v=c0uknFDcPgo

Conclusion

The principle of “all relevant information should be included in financial reports” is a cornerstone of financial transparency. By providing comprehensive and accurate financial information, companies can build trust with their stakeholders, make informed decisions, and navigate the financial landscape with greater assurance. Embrace transparency as a core value, and your company will reap the benefits of a strong and sustainable financial foundation.

Are you interested in learning more about the importance of financial reporting transparency? Share your thoughts in the comments below!