Have you ever wondered how many units you need to sell to cover all your business expenses? Or perhaps you’ve been staring at a spreadsheet, struggling to understand the complex relationship between costs, revenue, and profit. This is where the break-even point comes in – a vital concept that can help you navigate the financial landscape of your business. Think of it as your business’s financial “sweet spot” – the point where your revenue exactly matches your expenses. In this article, we’ll dive into the world of break-even analysis, unraveling the essential questions and answers you need to unlock your business’s financial potential.

Image: www.studocu.com

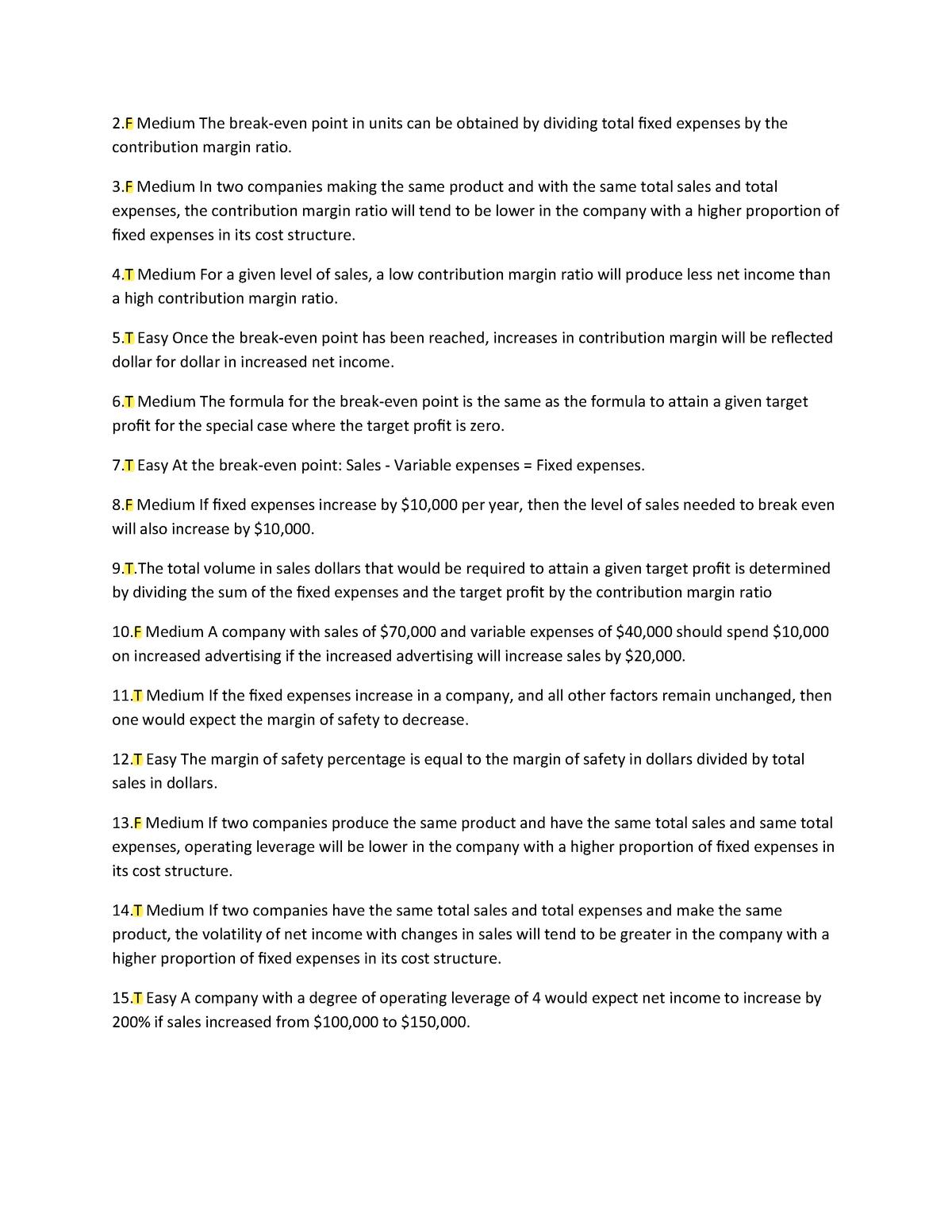

The break-even point represents the critical threshold your business needs to cross to transition from losses to profits. It’s a powerful tool for entrepreneurs, business owners, and even financial analysts to understand the financial viability of a project or venture. Understanding your break-even point allows you to make informed decisions about pricing, marketing, and production, ultimately paving the path to profitability.

Understanding the Essentials: What is the Break-Even Point?

The break-even point (BEP) is the point at which total revenue equals total costs. Essentially, it’s the sales volume you need to reach to cover all your expenses. While there’s a general formula, its calculation depends on whether you are considering a product or service.

Break-Even Point for a Product

Formula:

Break-Even Point in Units = Fixed Costs / (Selling Price Per Unit – Variable Costs Per Unit)

- Fixed Costs: Costs that remain constant regardless of the volume of goods produced or services offered (rent, salaries, insurance).

- Variable Costs: Costs that fluctuate with production or service volume (raw materials, packaging, direct labor).

- Selling Price Per Unit: The price at which each unit is sold.

Let’s break this down with a simple example. Imagine you run a bakery selling cupcakes. Your fixed costs are $1,000 per month (rent, utilities, etc.). Your variable cost per cupcake is $1 (ingredients, packaging), and you sell each cupcake for $3.

Break-Even Point in Units:

- $1,000 / ($3 – $1) = 500 cupcakes

This means you need to sell 500 cupcakes to cover all your costs. Any sales beyond that point will generate profit.

Break-Even Point for a Service

Formula:

Break-Even Point in Units = Fixed Costs / (Service Price Per Unit – Variable Costs Per Unit)

This formula is essentially identical to the product formula, with the main difference being that “units” refer to service units. For example, this might mean the number of hours billed for a service, or the number of consultations offered.

Image: www.studypool.com

Break-Even Point Example Questions and Answers

Let’s explore some key break-even point scenarios, unraveling their complexities and providing actionable insights.

1. How to Calculate the Break-Even Point in Sales Revenue?

Question: Instead of units, can I calculate the break-even point using revenue?

Answer: Absolutely! Use the following formula:

Break-Even Point in Sales Revenue = Fixed Costs / ((Selling Price Per Unit – Variable Costs Per Unit) / Selling Price Per Unit)

Example: Using our cupcake example, the break-even point in sales revenue would be:

- $1,000 / (($3 – $1) / $3) = $1,500

This means you need to generate $1,500 in sales to cover your costs.

2. What Happens When Variable Costs Increase?

Question: My supplier has announced a price increase on my raw materials. How will this impact my break-even point?

Answer: Higher variable costs will increase your break-even point. This means you’ll need to sell more units to cover your costs. For example, if your variable cost per cupcake increases to $1.50, your new break-even point in units would be:

- $1,000 / ($3 – $1.50) = 667 cupcakes

This means you need to sell 167 more cupcakes to break even.

3. How can I Lower My Break-Even Point?

Question: I want to make my business more profitable by reducing my break-even point. How can I achieve this?

Answer: You have a few options. You can:

- Lower your fixed costs: Negotiate better rent rates, streamline operations to reduce overhead expenses, or explore cost-cutting measures.

- Increase your selling price per unit: However, be mindful of market demand and competitor pricing.

- Reduce your variable costs: Find more cost-effective suppliers, negotiate better material prices, or improve production efficiency.

4. Can I Use the Break-Even Point to Analyze a New Product?

Question: I’m considering launching a new product line. How can I use the break-even point to guide my decision?

Answer: Absolutely! Before launching, perform a break-even analysis to understand the quantity you need to sell to cover costs. This provides invaluable insight into the product’s potential profitability.

5. How Can I Use A Break-Even Point Calculator?

Question: I see several online break-even calculators. How do I use them effectively?

Answer: Break-even point calculators can be helpful, but make sure you utilize a reliable and trustworthy resource. First, identify your fixed costs. Next, determine your variable cost per unit (material costs, labor, packaging). Lastly, input your selling price per unit. These calculators will calculate your break-even point in units and revenue.

6. Can I Incorporate Break-Even Analysis into Marketing Strategies?

Question: Can a break-even analysis guide my marketing decisions?

Answer: Absolutely. By understanding your break-even point, you can make informed decisions about marketing campaigns. A break-even analysis can help you determine the volume of sales needed to offset the cost of marketing initiatives, enabling you to make strategic choices about spending and campaign effectiveness.

7. How Can I Utilize the Break-Even Point for Production Planning?

Question: I’m struggling to manage my inventory levels and production. Can the break-even point help?

Answer: Understanding your break-even point helps you plan production volume effectively. By identifying the minimum units needed to cover costs, you can avoid overproducing and wasting resources, while also ensuring you have enough product to meet demand.

8. Can a Break-Even Analysis Help with Pricing Decisions?

Question: I want to ensure my pricing strategies are profitable. Can a break-even analysis help?

Answer: Understanding your break-even point helps you determine the ideal pricing for your products or services. By factoring in your costs and desired profit margin, you can set a selling price that ensures you achieve profitability.

9. What are the Limitations of the Break-Even Point Analysis?

Question: I’ve heard that break-even analysis has limitations. Should I be aware of these?

Answer: Break-even analysis provides valuable insights, but it’s vital to acknowledge its limitations:

- Static Analysis: It assumes fixed costs remain constant, and variable costs per unit remain consistent. However, in reality, costs fluctuate over time.

- Demand Uncertainty: It doesn’t account for the impact of fluctuating demand.

- Oversimplification: It doesn’t consider factors like product mix, seasonality, or potential for future growth.

10. How Can I Improve the Accuracy of my Break-Even Analysis?

Question: Can I make my break-even analysis more robust?

Answer: To enhance accuracy, consider:

- Regularly review and update your data: Use the most current cost and revenue information to ensure your calculations are accurate.

- Factor in time value of money: Incorporate a discount rate to account for the time value of money, especially when evaluating projects with a longer timeline.

- Perform sensitivity analysis: Explore how varying input factors (costs, prices, demand) impact your break-even point.

Expert Insights: Navigating the Break-Even Point

According to renowned financial expert Jane Smith, “The break-even point is a critical financial benchmark that every entrepreneur should understand. It’s not just about reaching zero profit; it’s about understanding the underlying relationship between cost and revenue, which guides your business strategy.”

To further empower your journey, here are a few valuable tips from experts:

- Don’t just focus on the break-even point in units. Analyze it in terms of sales revenue and profit.

- Use the break-even point as a starting point, not an endpoint. Continuously strive to improve efficiency, reduce costs, and increase sales volume to enhance profitability.

- Collaborate with your accounting team. They can help you refine your cost data and provide expert insights into financial performance.

Break-Even Point Example Questions And Answers

Break-Even Point: A Powerful Tool for Success

The break-even point is an invaluable tool for any business owner or entrepreneur. By understanding how to calculate it and applying its principles, you can gain valuable insights into the financial health and sustainability of your enterprise. Embrace the power of break-even analysis, and equip yourself with the knowledge to navigate the path to profitability. Share your experiences with break-even analysis in the comments below and let’s continue to learn from each other!