Imagine this: you’re in the middle of securing a loan or a lease agreement, but there’s a snag – you don’t meet the lender or landlord’s financial requirements. It can feel like a dead end, right? But what if there was a way to bridge that gap? Enter the guarantor letter, a powerful tool that can open doors to financial opportunities.

Image: gotilo.org

A guarantor letter is a formal document where a third party, known as the guarantor, pledges to be financially responsible for another individual’s obligations. It’s a way to act as a safety net, reassuring the lender or landlord that the debt or rent will be paid even if the primary borrower defaults. This is particularly helpful for individuals who may lack a strong credit history, require additional financial support, or are seeking a more favorable loan or lease agreement.

Understanding the Purpose of a Guarantor Letter

Before diving into the specifics of writing a guarantor letter, let’s clarify its purpose and why it’s so crucial in various scenarios. Here are some key reasons why guarantor letters are utilized:

- Securing Loans: For borrowers with limited credit history or a low credit score, a guarantor letter can tip the scales in their favor. A reliable guarantor demonstrates a level of financial trust that can sway lenders to approve the loan application.

- Lease Agreements: In the rental market, a guarantor letter can be invaluable for tenants facing financial hurdles. It provides landlords with added assurance that rent payments will be covered even if the primary tenant encounters difficulties.

- Student Loans: Guarantor letters are commonly used in student loan scenarios, particularly for international students who may not have a U.S. credit history. A guarantor, often a parent or family member, steps in to ensure repayment if the student defaults.

- Business Ventures: Guarantor letters can support budding entrepreneurs by providing a financial safety net for business loans or investments. A trusted guarantor can significantly enhance the credibility of a new venture.

The Essentials of a Guarantor Letter

Now that you have a grasp of the importance of a guarantor letter, let’s break down its key elements. A well-written letter should:

1. Clearly Identify the Parties Involved

- Start with a formal salutation, addressing the recipient clearly (e.g., “Dear [Lender/Landlord Name]”).

- Explicitly state the guarantor’s full legal name and address.

- Include the individual’s full name and address for whom the guarantor is providing assurance (e.g., “I, [Guarantor Name], am providing this guarantee on behalf of [Borrower/Tenant Name]”).

Image: templatelab.com

2. Specify the Agreement Details

The letter needs to outline the exact nature of the agreement for which the guarantor is assuming responsibility. This means:

- State the type of agreement: Is it a loan, a lease, or a different form of financial obligation?

- Clarify the amount: If applicable, state the loan amount or maximum rent payment that the guarantor is responsible for.

- Specify the duration: Indicate the time period for which the guarantor’s guarantee extends (e.g., the loan term or duration of the lease).

3. Express the Guarantor’s Commitment

The central focus of the letter lies in the guarantor’s commitment. Ensure that this commitment is clearly stated. Here’s how to express it effectively:

- Use strong and unambiguous language: “I, [Guarantor Name], hereby unconditionally guarantee the prompt and full payment of…” This conveys a clear understanding of the guarantor’s responsibility.

- Mention the consequences of default: Include a statement highlighting that the guarantor acknowledges the financial implications of non-payment. This reinforces the seriousness of the agreement.

4. Sign and Date the Letter

The guarantor letter must be signed and dated. This formalizes the document and makes it legally binding.

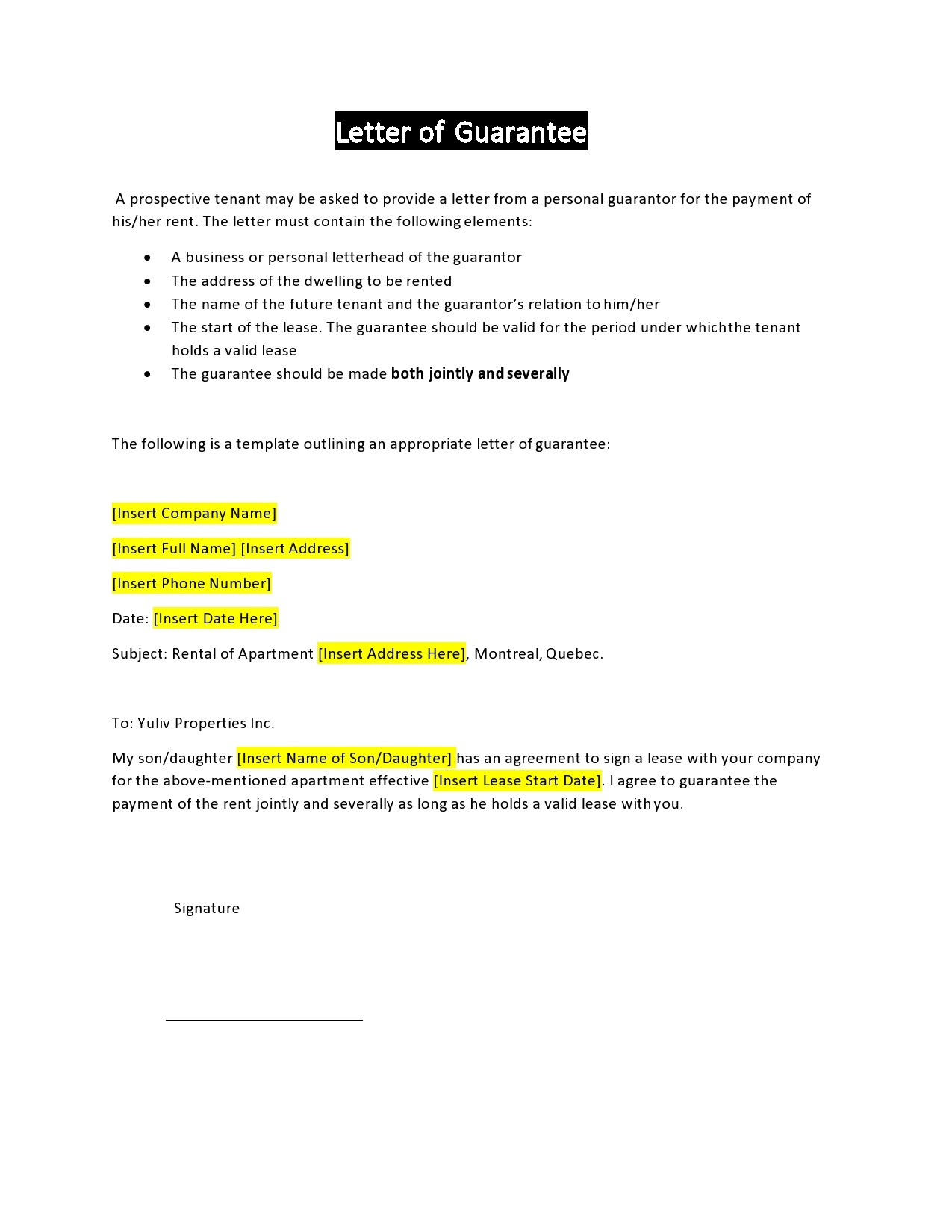

Sample Guarantor Letter

Here’s an example of a basic guarantor letter. Remember, it’s essential to adapt this to your specific situation and agreement details.

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Recipient Name]

[Recipient Address]

Dear [Recipient Name],

This letter confirms that I, [Your Name], am providing a guarantee for the following obligations:

[State Type of Agreement]

[State Details of Agreement]

I hereby unconditionally guarantee the prompt and full payment of all sums due and payable under this agreement. I understand that if [Borrower/Tenant Name] defaults on their obligations, I will be held liable and responsible for payment.

Sincerely,

[Your Name]

Important Considerations

While a guarantor letter can be a valuable tool, it’s crucial to understand the responsibilities and implications involved. Consider these points carefully before acting as a guarantor:

- Financial Capacity: Make sure you have the financial ability to cover the debt or rent payments if the primary borrower or tenant fails to do so. A thorough assessment of your own financial situation is vital.

- Understanding the Agreement: Read the loan agreement or lease agreement carefully. Comprehend the terms, the repayment schedule, and any potential penalties for default.

- Legal Implications: Be aware that by signing a guarantor letter, you are legally obligated to fulfill the agreement. Consult with an attorney to ensure that you fully understand the legal implications of your commitment.

Beyond the Basics: Tips for Crafting a Winning Letter

Here are some additional tips to make your guarantor letter stand out and increase your chances of success:

- Tailor the Letter: Each agreement is unique. Ensure that your guarantor letter is customized to the specific loan or lease agreement. Include relevant details about the agreement and your commitment to supporting the borrower or tenant.

- Provide Supporting Documentation: To further reinforce your credibility, consider attaching documentation like your latest credit report, proof of employment, or recent tax returns. This provides additional financial evidence of your ability to fulfill your guarantee.

- Maintain Clear Communication: After you’ve sent the letter, keep open communication with the lender or landlord. Respond to any inquiries promptly and provide updates as needed.

How To Write A Guarantor Letter

Conclusion

Guarantor letters can be a powerful tool for individuals seeking financial assistance or navigating complex agreements. Understanding the purpose, structure, and considerations involved can make the process smoother and increase the likelihood of a positive outcome. If you are considering acting as a guarantor, take the time to thoroughly assess your financial situation, understand the terms of the agreement, and consult with legal professionals to ensure you are making an informed decision. By following the guidelines and tips outlined in this article, you can create a compelling guarantor letter that effectively supports your loved ones and contributes to successful financial outcomes.