Have you ever wondered about the importance of the seemingly mundane Know Your Customer (KYC) forms at your bank? These forms, essential for institutions like the State Bank of India (SBI), are more than just a bureaucratic hurdle; they are a crucial layer of security that ensures the safety of your financial assets and protects the banking system as a whole. In this article, we’ll delve into the world of the SBI KYC Form PDF, exploring its significance, content, and how it impacts your banking experience.

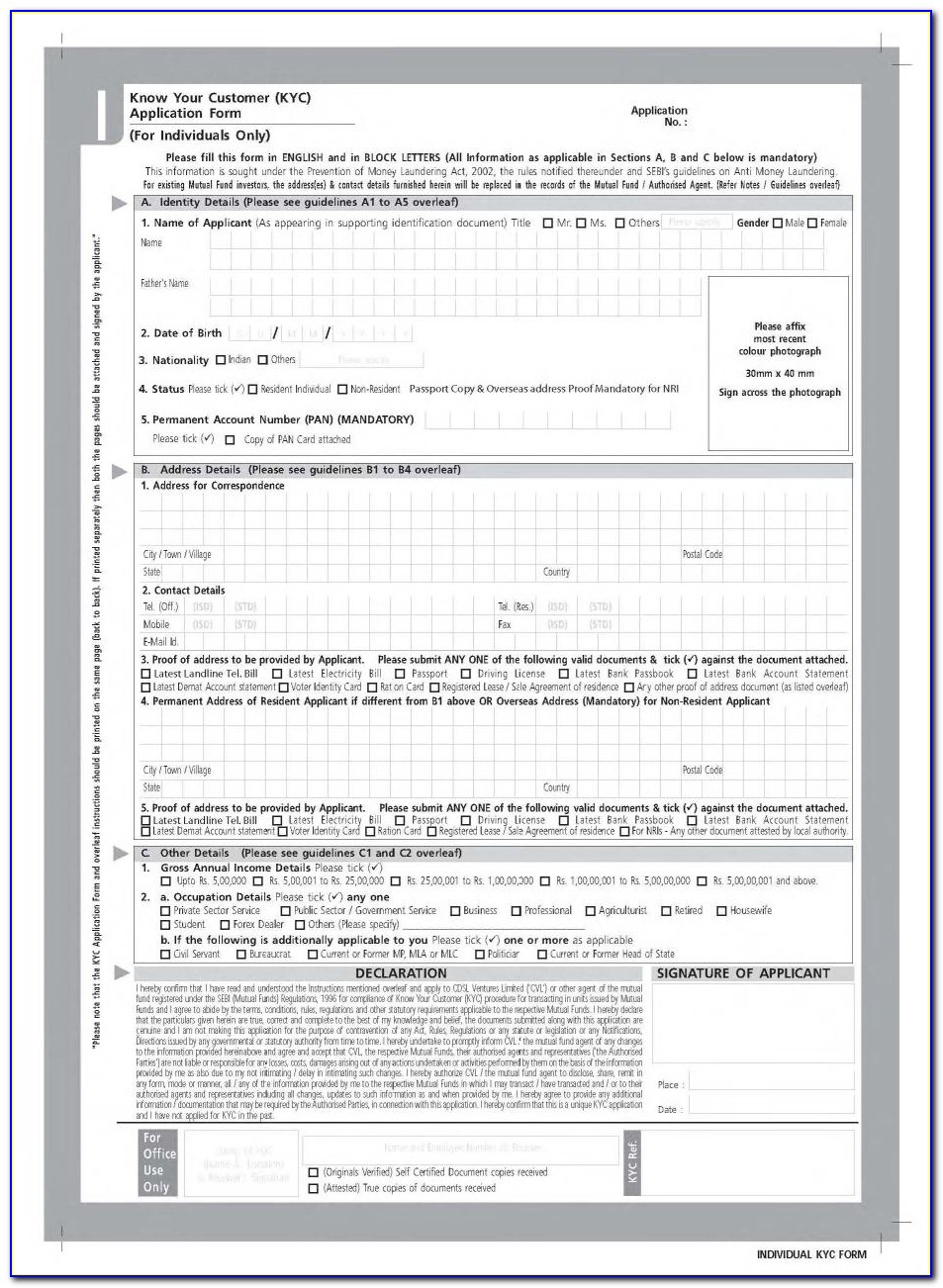

Image: printabletemplate.conaresvirtual.edu.sv

The SBI KYC form PDF is a document required by the bank to verify your identity and address. It’s the bank’s way of adhering to the Know Your Customer (KYC) regulations, a global standard aimed at preventing financial crimes such as money laundering and terrorism financing. These regulations mandate financial institutions to have a thorough understanding of their clients, ensuring that they are who they claim to be and their transactions are legitimate.

Understanding the Importance of KYC

Think of the KYC process as a rigorous security checkpoint at a high-security facility. Just like you wouldn’t be allowed access without proper identification and verification, the same principle applies to financial institutions. KYC allows SBI to:

- Identify and Verify Clients: By collecting and verifying your personal details, SBI ensures that you are who you claim to be.

- Prevent Fraud: The KYC process helps to prevent fraudulent activities like identity theft and money laundering.

- Comply with Regulations: SBI, as a bank operating in a global economy, must adhere to international regulations to ensure responsible financial practices.

- Enhance Security: The KYC process plays a crucial role in safeguarding your financial information and protecting the banking system from risks.

The Contents of an SBI KYC Form PDF

The SBI KYC form PDF is a comprehensive document that collects essential information about you. It usually includes:

- Personal Details: Name, date of birth, gender, nationality, PAN card details, and Aadhaar card details.

- Contact Information: Address, phone number, email address, and occupation.

- Financial Information: Details about your income, source of income, and financial history.

- Proof of Identity (POI) & Proof of Address (POA): You will need to submit copies of documents such as your passport, driver’s license, PAN card, or voter ID card for POI. For POA, documents like utility bills, bank statements, or a recent rent agreement are accepted.

How to Fill Out the SBI KYC Form PDF?

Filling out the SBI KYC form PDF is relatively straightforward. Here are some steps to ensure accuracy:

- Download the Form: Visit the SBI website or any SBI branch and download the KYC form in PDF format.

- Read the Instructions: Carefully read the instructions provided on the form before starting to fill it out.

- Provide Accurate Information: Ensure all the information you provide is correct and up-to-date. Double-check each detail before moving on.

- Attach Supporting Documents: Scan copies of your POI and POA documents and attach them to the form.

- Submit the Form: You can submit the completed form and supporting documents either online or in person at an SBI branch.

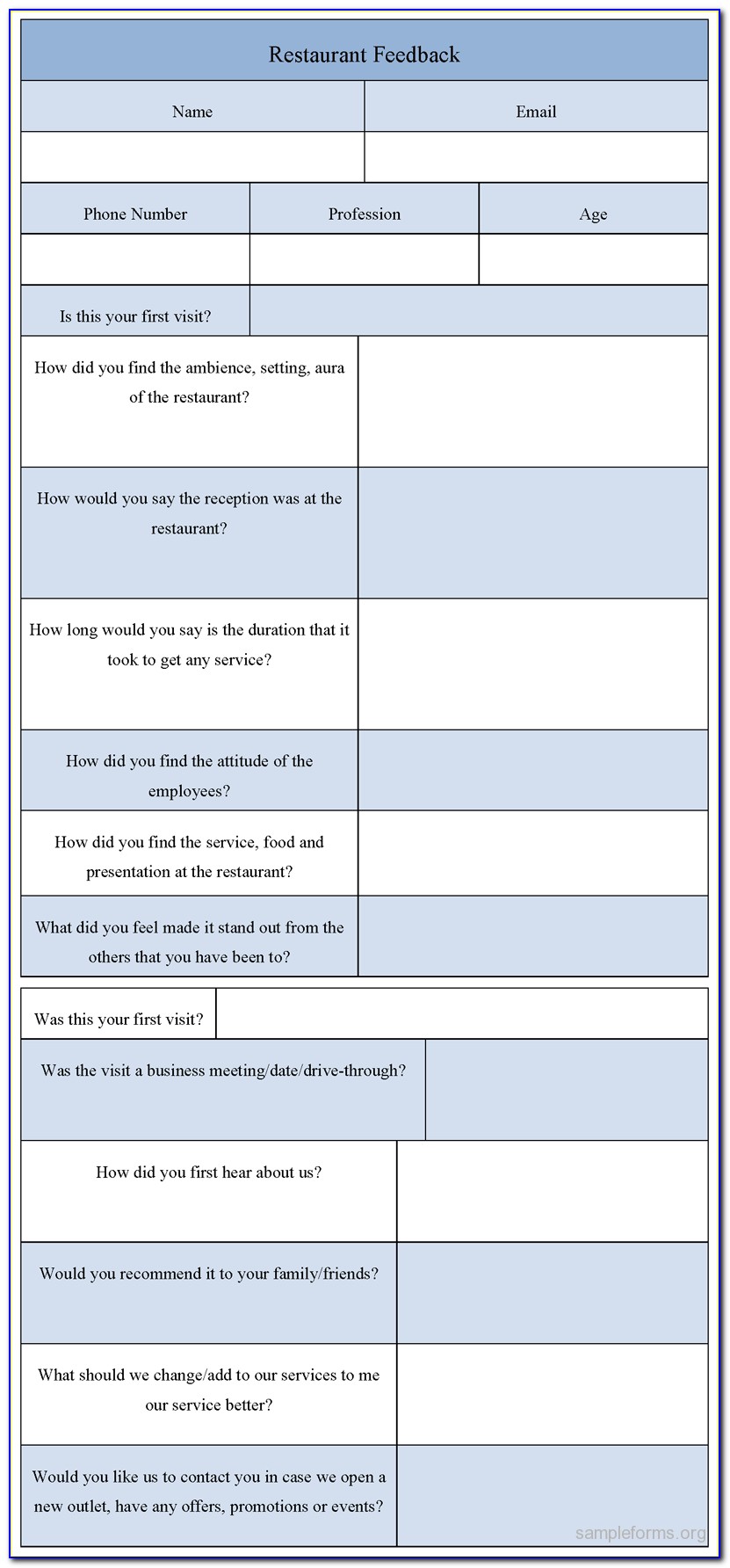

Image: www.viralcovert.com

Key Points to Remember

- Keep Your KYC Documents Updated: Always notify your bank of any changes in your personal or financial information, such as your address or contact details, to ensure your KYC profile remains accurate.

- Security Measures: Be cautious when submitting your KYC information online. Ensure you are using a secure website and avoid accessing sensitive information on public computers.

- Understand the Purpose: The KYC process is fundamental to ensuring the security and integrity of the banking system. By cooperating with the KYC requirements, you contribute to a safer and more reliable financial environment.

The Impact on your Banking Experience

The KYC process might seem like a formality, but it has a significant impact on your overall banking experience. Here’s how:

- Smoother Transactions: When your KYC details are updated and verified, you can enjoy hassle-free banking transactions, including account opening, loan applications, and international money transfers.

- Enhanced Security: The KYC process acts as a deterrent against fraudulent activities, protecting your financial assets from unauthorized access.

- Improved Service: By understanding your needs, SBI can offer you more tailored banking products and services.

Sbi Know Your Customer Form Pdf

Conclusion

The SBI KYC form PDF is a vital document that ensures a secure and responsible banking environment. While it might require some initial effort, it plays a crucial role in protecting your financial assets and ensuring the integrity of the banking system. By cooperating with the KYC process and keeping your details updated, you contribute to a safer and more efficient financial ecosystem.

Ultimately, understanding the importance of KYC forms allows you to become a more proactive participant in your financial journey, fostering trust and security in your banking experience. Remember, your KYC details are not just forms; they are a cornerstone of responsible financial practice.