Have you recently moved to New Jersey or are you planning to get car insurance for the first time? The world of insurance can be confusing, especially when it comes to navigating the specific requirements and nuances of different states. Understanding the significance of your Progressive Insurance ID number in New Jersey is crucial, ensuring you are properly protected on the road and avoid any potential hiccups.

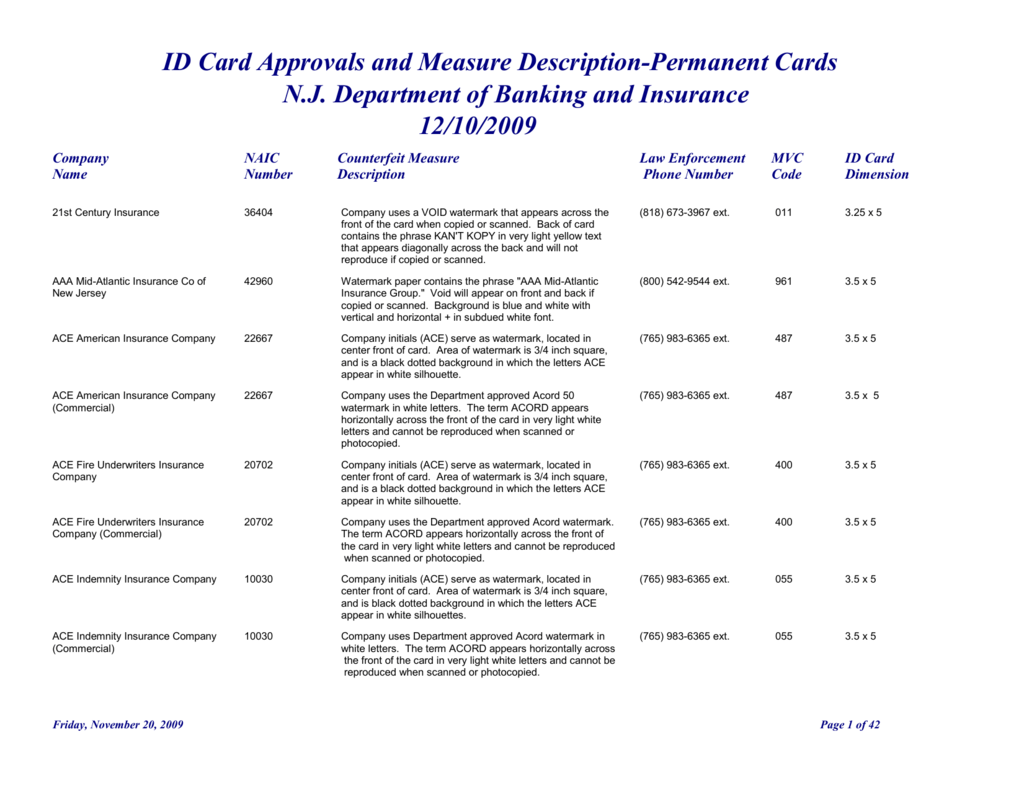

Image: studylib.net

This comprehensive guide aims to demystify the essential information surrounding Progressive insurance ID numbers in New Jersey. We will delve into the importance of this unique number, explain how to find it, and explore its role in managing your policy, ensuring you feel confident and empowered in effectively utilizing your insurance coverage.

The Importance of Your ID Number

Imagine yourself needing to file a claim after an accident. You frantically search your documents, only to realize you can’t find the crucial information necessary to connect with your insurance provider. This is where your Progressive insurance ID number becomes a lifeline. It acts as a unique identifier, acting as a key that unlocks essential information about your policy, enabling you to communicate efficiently and effectively with Progressive whenever you need them.

Understanding Your ID Number’s Role

Your Progressive insurance ID number is more than just a random string of numbers; it serves as a vital link to your car insurance coverage. Let’s break down exactly how it works:

-

Policy Retrieval: Need to access your insurance policy document, make changes, or update your information? Your ID number is the shortcut to easily locate your policy details within Progressive’s system.

-

Claim Reporting: In the unfortunate event of an accident, your ID number acts as a key to quickly connect you with the claims department, ensuring a smooth and efficient process.

-

Communication with Progressive: Whether you have a question, need assistance, or want to make changes to your coverage, your ID number acts as your identifier, ensuring your interaction with Progressive is swift and accurate.

Finding Your ID Number: A Simple Guide

Now that you understand the significance of your ID number, you may be wondering how to locate it:

-

Policy Documents: The simplest way is to refer to your insurance policy documents. Your ID number is usually prominently displayed on the first or second page.

-

Progressive Website: If you’ve registered for an online account with Progressive, you should be able to find it within your policy details under the “My Account” section.

-

Mobile App: Many insurance companies now have dedicated mobile apps. If you have a Progressive app, your ID number is likely accessible in “My Account” or the policy information section.

-

Phone Call: If you’ve misplaced your documents and haven’t yet registered online, a simple phone call to Progressive’s customer service line will allow you to retrieve your ID number with the help of your personal information.

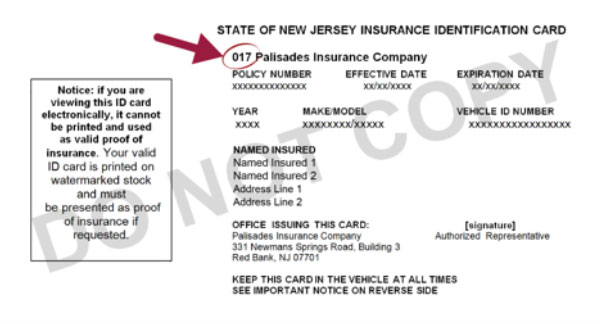

Image: startirish.weebly.com

Keeping Your Information Safe: Best Practices

With any important identifier, it’s crucial to prioritize security. Follow these simple steps to prevent unauthorized use of your ID number:

-

Secure Documents: Store your insurance policy documents in a secure location, preferably a fireproof safe or safe deposit box.

-

Regularly Check Your Account: Make it a habit to check your Progressive account online or via your app to assure no unauthorized activity is taking place.

-

Strong Passwords: If you access your account online, ensure you are using strong passwords and enable any two-factor authentication options available for added security.

-

Beware of Scams: Be cautious of any unsolicited calls or emails claiming to need your ID number. Always verify requests directly through official Progressive channels.

Tips for Maximizing Your Insurance Coverage in New Jersey

Now that you’re equipped with the knowledge of your ID number and its role in managing your insurance, let’s dive into some valuable tips specific to New Jersey:

-

New Jersey’s Minimum Coverage: Be aware of the minimum car insurance requirements mandated by the state. Failing to meet these requirements can result in costly penalties.

-

Optional Coverages: Consider adding optional coverages to further enhance your protection. These include:

- Collision Coverage: Covers damage to your vehicle in an accident, regardless of fault.

- Comprehensive Coverage: Protects you from damage caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Underinsured/Uninsured Motorist Coverage: Provides financial protection if you’re involved in an accident with a driver who doesn’t have adequate insurance.

-

NJ’s No-Fault System: New Jersey has a no-fault insurance system. Understanding its specifics is essential to navigating claims and obtaining appropriate benefits.

-

NJ Motor Vehicle Commission (MVC): The MVC is the state agency responsible for car registration and insurance. Regularly check for updates or changes related to New Jersey car insurance regulations.

Progressive Insurance Company Id Number Nj

Conclusion: Mastering Your Insurance Journey in New Jersey

Your Progressive insurance ID number is an indispensable tool in navigating the complexities of car insurance in New Jersey. Armed with this knowledge, you are empowered to confidently manage your policy, communicate effectively with your insurer, and ensure you are properly protected on the road. Remember to store your ID number securely, check your account regularly, and familiarize yourself with New Jersey’s specific insurance requirements. By taking these steps, you can approach your insurance journey with a sense of assurance and control, knowing you have the right information to make informed decisions.