Have you ever found yourself in the unfortunate position of chasing unpaid invoices? It’s a frustrating experience that sadly many businesses face. You poured your heart and soul into providing a valuable service or product, only to be met with silence – or worse, excuses and delays.

Image: simpleartifact.com

Enter the letter of demand for outstanding payment PDF, a powerful tool that can help you reclaim what’s rightfully yours. This document, crafted thoughtfully and strategically, can transform a passive “wait and see” approach into a proactive stance that demands attention and potentially avoids costly legal battles. Let’s delve deeper into the intricacies of this crucial document and understand how it can work in your favor.

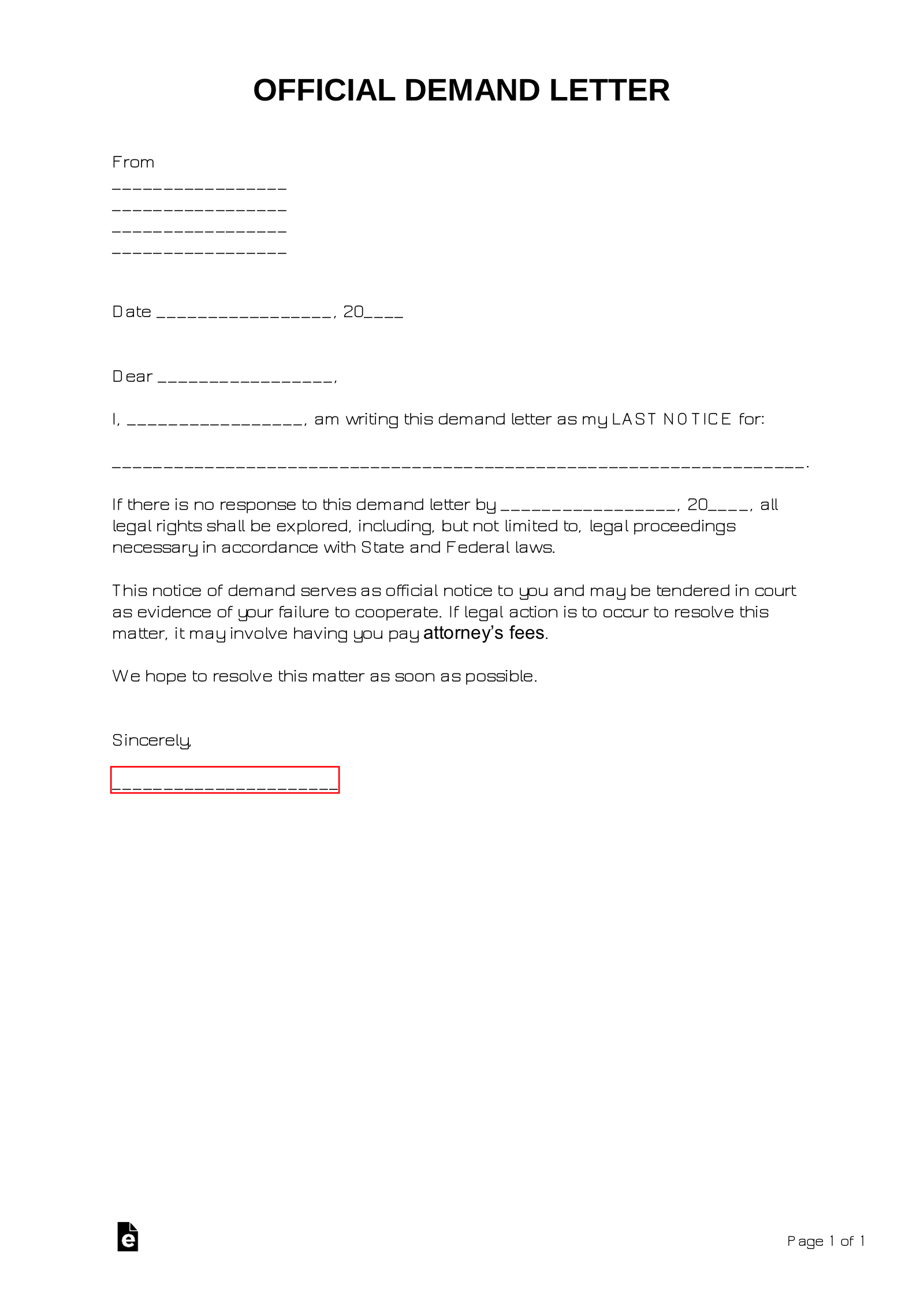

Understanding the Letter of Demand

What is a Letter of Demand?

A letter of demand is a formal written notification sent to a debtor outlining the outstanding debt owed, the terms of repayment, and a clear timeframe for action. It is a critical step in the debt collection process, serving as a firm and persuasive reminder of the unpaid obligation. This document signifies a serious intent to pursue recovery if payment isn’t promptly forthcoming.

Why Use a Letter of Demand?

Think of a letter of demand as a well-placed “wake-up call.” Its purpose is to:

- Establish a clear record: Documenting the debt and its terms protects your rights in case legal action becomes necessary.

- Communicate firmly and professionally: It ensures a professional approach while leaving no room for ambiguity about the outstanding payment.

- Set a clear deadline: This creates a sense of urgency and encourages prompt action on the debtor’s part.

- Reduce the risk of long-term debt hassle: Early intervention often prevents debts from spiraling out of control and leading to costly legal proceedings.

- Increase the likelihood of successful debt recovery: A well-constructed letter often prompts debtors to prioritize payment to avoid potential consequences.

Image: eforms.com

The Structure of a Letter of Demand

A well-crafted letter of demand should follow a clear structure for optimal impact.

Essential Components

- Your Contact Information: Include your complete name, business address, and relevant contact details (phone number, email address) for ease of communication.

- Debtor’s Contact Information: Be precise with the debtor’s accurate name, address, and contact information to ensure proper delivery.

- Invoice Details: Clearly identify the unpaid invoice number, date of invoice, and the amount owed. Include a detailed breakdown if necessary.

- Terms of Payment: State the agreed upon payment terms (such as net 30 days), the due date, and the acceptable payment methods.

- Consequences of Non-Payment: Express the potential consequences of non-payment, such as late fees, interest charges, and possible legal action. This creates a sense of urgency and underscores the seriousness of the situation.

- Deadline for Payment: Provide a specific and reasonable deadline for the debtor to make full payment. It’s essential to maintain a professional tone while being firm in your expectations.

- Conclusion: End the letter with a clear call to action, requesting the debtor to contact you immediately to discuss the payment arrangements. Reinforce that you are committed to resolving this matter amicably.

Crafting a Persuasive Letter

While firmness is essential, a good letter of demand avoids being overtly aggressive. Its goal is to encourage the debtor to act quickly while building a foundation for a potential productive conversation.

Tips for a Compelling Letter:

- Professional Tone: Maintaining a professional and courteous tone is crucial. Avoid any language that could be perceived as threatening or insulting.

- Clear and Concise: Keep the language straightforward and easily understandable. Avoid technical jargon or overly complex legal terms.

- Specific Details: Provide as much detailed information about the debt as possible, including the exact amount owed, dates, and relevant terms.

- Proof of Delivery: Utilize a method of delivery that allows for proof of receipt, such as registered mail with a return receipt or an email with a read confirmation. This creates a solid paper trail in case legal action is pursued.

- Consider Legal Advice: If you’re dealing with a complex or high-value debt, consulting a lawyer can help ensure the letter is legally compliant and provides the strongest possible foundation for recovery.

Utilizing Your Letter of Demand PDF

For maximum effectiveness, you’ll want to ensure your letter of demand PDF is properly utilized and followed up on.

Tips for Success:

- Choose the Right Template: Utilize a professionally designed template that provides a clean and organized layout. There are numerous online resources available, or you can seek assistance from a legal professional.

- Personalize: Avoid using a generic template that doesn’t address the specific debt and debtor. Personalization demonstrates that you’ve taken the time to understand their situation and are serious about resolving the matter.

- Follow Up: After sending the letter, follow up with a phone call or email to gauge the debtor’s response. This demonstrates your persistence and commitment to resolving the issue.

- Be Patient: While persistence is key, understand that some debtors may need more time to respond. Remain patient and flexible while still maintaining a firm stance on the payment due.

- Escalate When Necessary: If the debtor fails to respond within the agreed-upon timeframe or refuses to engage in a productive conversation, you may need to escalate the situation. This could involve consulting an attorney or engaging a debt recovery agency.

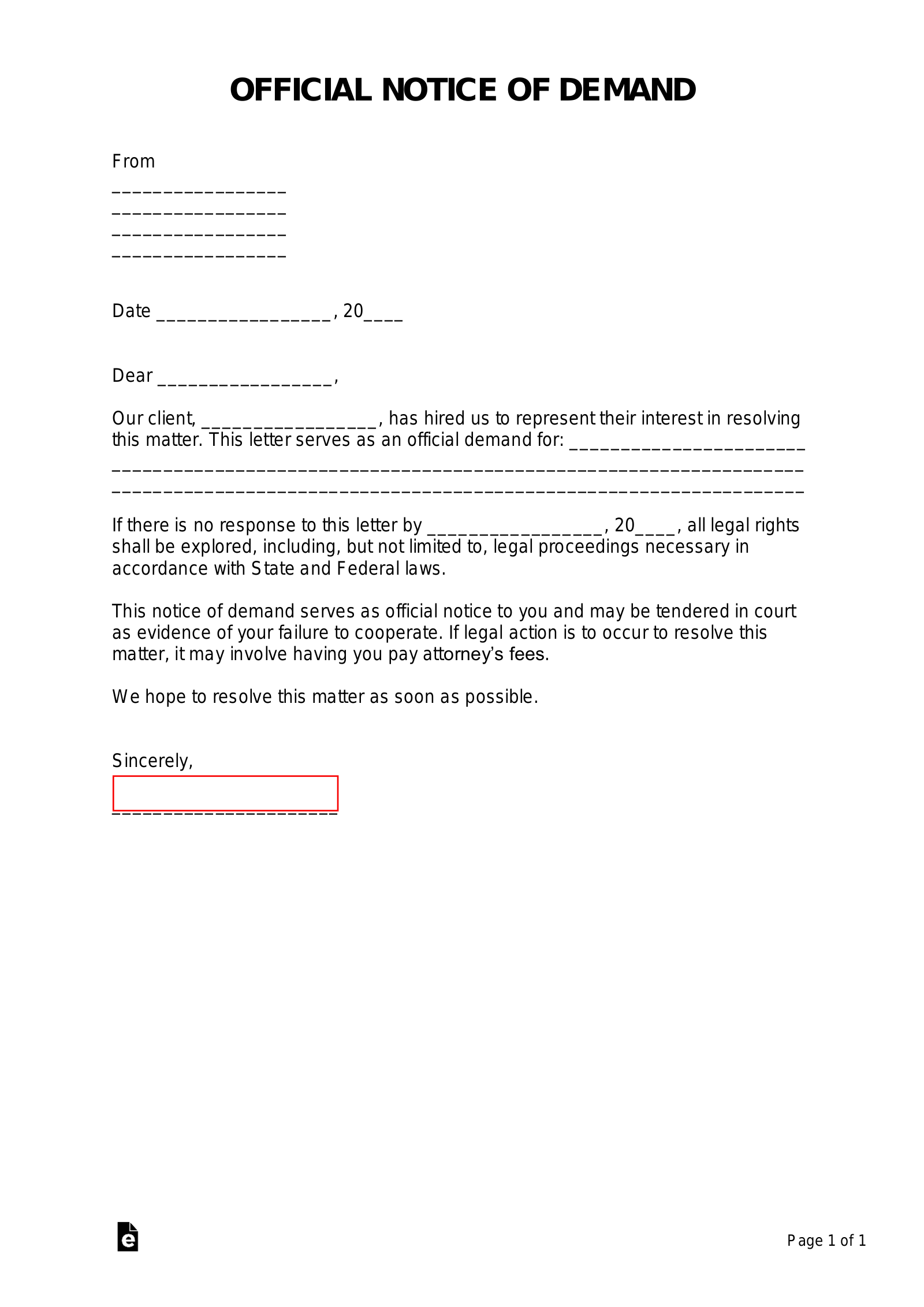

Examples of Effective Letter of Demand PDFs

To give you a clearer idea, here are a few examples of strong elements to include in your letter of demand:

Example 1: Strong Opening Statement: “This letter serves as a formal demand for payment of the outstanding invoice [invoice number] in the amount of [amount owed]. This invoice was due [date] and, despite multiple attempts to reach you by phone and email, remains unpaid.”

Example 2: Clear Consequences: “Failure to settle this debt within [number] days of the date of this letter will result in further action, including the initiation of legal proceedings, the referral to a debt collection agency, and potential damage to your credit rating.”

Example 3: Emphasis on Payment Options: “To facilitate a swift resolution, we encourage you to contact us immediately to discuss flexible payment options, such as a payment plan, to address this outstanding debt.”

Letter Of Demand For Outstanding Payment Pdf

Conclusion: A Powerful Tool for Recovery

The letter of demand for outstanding payment PDF is a valuable tool in the debt collection process, allowing businesses to effectively communicate their expectations and set a firm foundation for regaining control of unpaid invoices. By utilizing the tips outlined above, you can create a concise and persuasive document that encourages timely action from the debtor and sets the stage for a successful outcome. Remember, proactive and well-planned measures are often crucial for avoiding costly legal battles and ensuring that your business receives the compensation it deserves.